🚀 1099 Form Wisconsin

Effortless 1099 Form Wisconsin Generation for Your Business Needs

Navigate 1099 Form Wisconsin Requirements with Ease

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

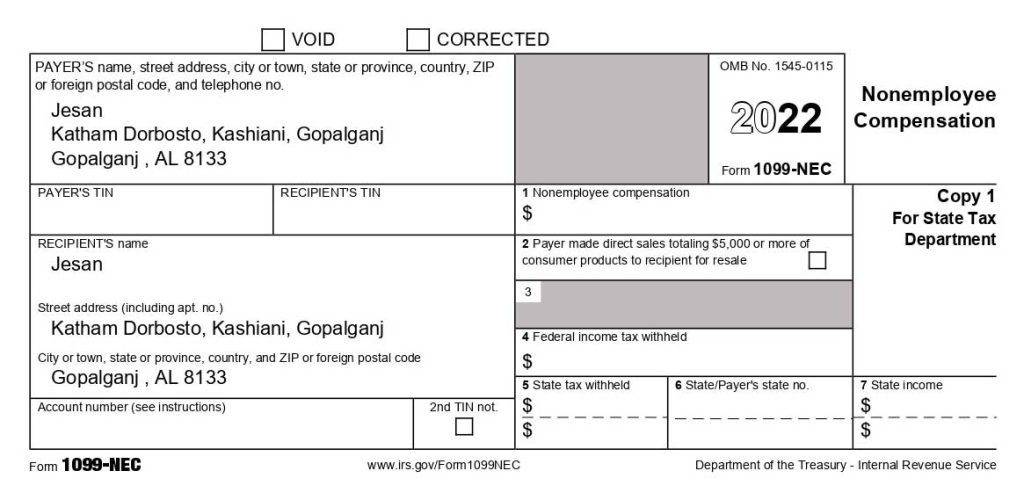

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

The Intricacies of 1099 Form Wisconsin: Essential Knowledge for Businesses and Freelancers

The 1099 Form is an essential IRS tax document used in the United States, playing a crucial role for individuals and businesses in Wisconsin. This form is primarily used to report income earned outside of traditional employment, such as payments made to independent contractors, freelancers, and other non-employees. In Wisconsin, the 1099 Form holds particular significance due to the state’s specific tax regulations. It covers various types of income, from self-employment earnings to interest, dividends, and government payments. Accurate reporting on the 1099 Form is vital to meet both federal and Wisconsin state tax obligations. The form helps in ensuring transparent income declaration and aids in the accurate calculation of taxes owed.

Wisconsin’s regulations necessitate meticulous attention to detail in reporting income, especially for businesses that engage multiple contractors. Failing to accurately report this information can lead to compliance issues and potential penalties. Understanding the nuances of the 1099 Form Wisconsin is not just about fulfilling legal requirements; it’s about fostering a transparent and responsible financial environment. Our service simplifies this complex process, offering a reliable and efficient way to manage and generate these forms, ensuring compliance with all Wisconsin-specific legal requirements. We aim to provide peace of mind for businesses and independent professionals alike, making tax reporting a seamless and error-free process.

Addressing the Challenges of 1099 Form Wisconsin in the Market

Navigating the complexities of the 1099 Form in Wisconsin poses a significant hurdle for businesses and independent professionals. The meticulous nature of state-specific tax laws makes the process prone to errors and compliance issues. For many, understanding the intricate details required for accurate reporting is overwhelming, leading to potential inaccuracies and IRS penalties. The traditional methods of generating these forms are often cumbersome and error-prone, adding to the administrative burden. This challenge is compounded for businesses dealing with multiple contractors, where the risk of mistakes is amplified. There’s a clear market need for a streamlined, error-free approach to managing these forms, ensuring adherence to Wisconsin’s specific tax regulations.

Revolutionizing 1099 Form Wisconsin Management: Our Solution

Our solution to the challenges of managing 1099 Form Wisconsin lies in our innovative online platform, designed to simplify and streamline the entire process. By automating the generation of these forms, we significantly reduce the risk of human error, ensuring accuracy and compliance with Wisconsin’s specific tax laws. Our system not only makes the process faster but also more reliable, freeing businesses and professionals from the complexities of manual form preparation. We provide real-time guidance and automatic updates to reflect the latest tax regulations, ensuring that every form generated meets the current legal standards. This approach transforms the tedious task of 1099 form management into a hassle-free, efficient experience, providing peace of mind and freeing up valuable time for our users.

Advanced Features of Our 1099 Form Wisconsin Generator

Our 1099 Form Wisconsin generator stands out with its cutting-edge features, designed to cater to the specific needs of businesses and independent professionals in Wisconsin. Understanding the intricacies of state-specific tax laws, we’ve developed a platform that prioritizes efficiency, accuracy, and compliance. The key features include real-time error checking, which instantly identifies and suggests corrections for any inaccuracies, ensuring the forms are error-free before submission. Automated state-specific adjustments are another critical aspect, where our system automatically aligns with the latest Wisconsin tax regulations, providing an up-to-date, compliant solution. Furthermore, our platform’s user-friendly interface simplifies the form generation process, making it accessible to users with varying levels of tax knowledge. Data security is paramount in our service, and we ensure the utmost protection of sensitive information with robust security measures. These features collectively make our service an indispensable tool for hassle-free 1099 form generation in Wisconsin.

Maximize Your Time with Efficient Form Generation

Our platform significantly cuts down the time required to generate 1099 forms. With intuitive navigation and automated data entry, users can complete forms quickly and accurately, freeing up valuable time for other business activities.

Accuracy in Every Detail

Precision is key in tax documentation. Our platform's real-time error detection and correction capabilities ensure that every form is meticulously reviewed for accuracy, thereby reducing the likelihood of IRS audits and penalties.

Stay Compliant with Ease

Navigating the complex tax laws of Wisconsin is made effortless. Our platform stays updated with the latest tax regulations, ensuring every form generated is compliant with current state laws, giving users peace of mind.

Your Office, Anywhere

Flexibility is at the forefront of our service. Whether at the office or on the go, our platform is accessible on various devices, enabling users to manage their tax documentation anytime, anywhere, with ease.

Enhancing Your Experience with 1099 Form Wisconsin

Discover the Advantages of Our 1099 Form Wisconsin Service

Unlocking the Potential of 1099 Form Wisconsin

Maximize Efficiency and Compliance with Our 1099 Form Wisconsin Solutions

Streamlined Process

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Mastering the 1099 Form Texas Creation with Paystub Hero

A Step-by-Step Guide to Effortlessly Generate Your 1099 Form Texas

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate 1099

Instantly create a digital copy.

4. Download

Access your 1099 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

The 1099 Form is an IRS tax form used in the United States for reporting income earned outside of traditional employment. In Wisconsin, this form is particularly important for individuals and businesses because it reports income from sources like freelance work, independent contracting, and other non-employee compensations. Accurate filing of the 1099 Form is crucial in Wisconsin to ensure compliance with state tax laws, avoid penalties, and maintain transparent financial records.

In Wisconsin, any business or individual that makes certain types of payments, including non-employee compensation, rent, or other income payments, totaling $600 or more in a year to a single payee, must file a 1099 Form. This requirement is particularly relevant for businesses that work with independent contractors or freelancers. It's essential for these entities to understand their reporting obligations to stay compliant with Wisconsin tax laws.

There are several types of 1099 Forms, each designed for different types of income. The most common is the 1099-NEC, used for reporting non-employee compensation. Wisconsin residents may also encounter forms like 1099-MISC for miscellaneous income, 1099-DIV for dividends and distributions, and 1099-INT for interest income. The relevant form depends on the nature of the income received.

Our online 1099 Form Wisconsin generator simplifies the creation of accurate and compliant 1099 forms. Users enter their financial data, and the platform automatically populates the form with the relevant information, ensuring adherence to Wisconsin's specific tax regulations. It also checks for common errors, making the process efficient and user-friendly.

The deadline for filing 1099 Forms with the IRS and providing a copy to the recipient is typically January 31st for the previous tax year. However, if this date falls on a weekend or holiday, the deadline may be the next business day. It's important for Wisconsin filers to stay aware of these deadlines to avoid penalties for late filing.

Failing to file or incorrectly filing a 1099 Form in Wisconsin can lead to significant penalties. These may include fines for each form not correctly filed and additional charges for intentional disregard of filing requirements. The exact penalty depends on how late the filing is and the nature of the error.

Yes, electronic filing of 1099 Forms is available and often recommended in Wisconsin. Our online 1099 Form Wisconsin generator is equipped to facilitate this process, offering a seamless electronic filing experience. Electronic filing is not only faster but also more secure and environmentally friendly.

Ensuring compliance involves accurately reporting all required information and adhering to Wisconsin's specific tax laws. Using our specialized 1099 Form Wisconsin generator can greatly assist in this process, as it's updated with the latest state tax regulations and designed to prevent common mistakes.

If you need to amend a 1099 Form after filing it in Wisconsin, you can do so by filling out a new form with the correct information and checking the "corrected" box. It's important to provide the amended form to both the IRS and the recipient as soon as possible to ensure all parties have the correct information.

Absolutely. Besides our comprehensive online generator, Wisconsin residents can access resources from the Wisconsin Department of Revenue and the IRS for guidance. Additionally, our customer support team is available to assist with any queries related to 1099 Form Wisconsin generation and compliance.