🚀 1099 Self Employed Form

Effortlessly Create Your 1099 Self Employed Form with PayStubHero

Streamline Your Tax Reporting with Our 1099 Self Employed Form Generator

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

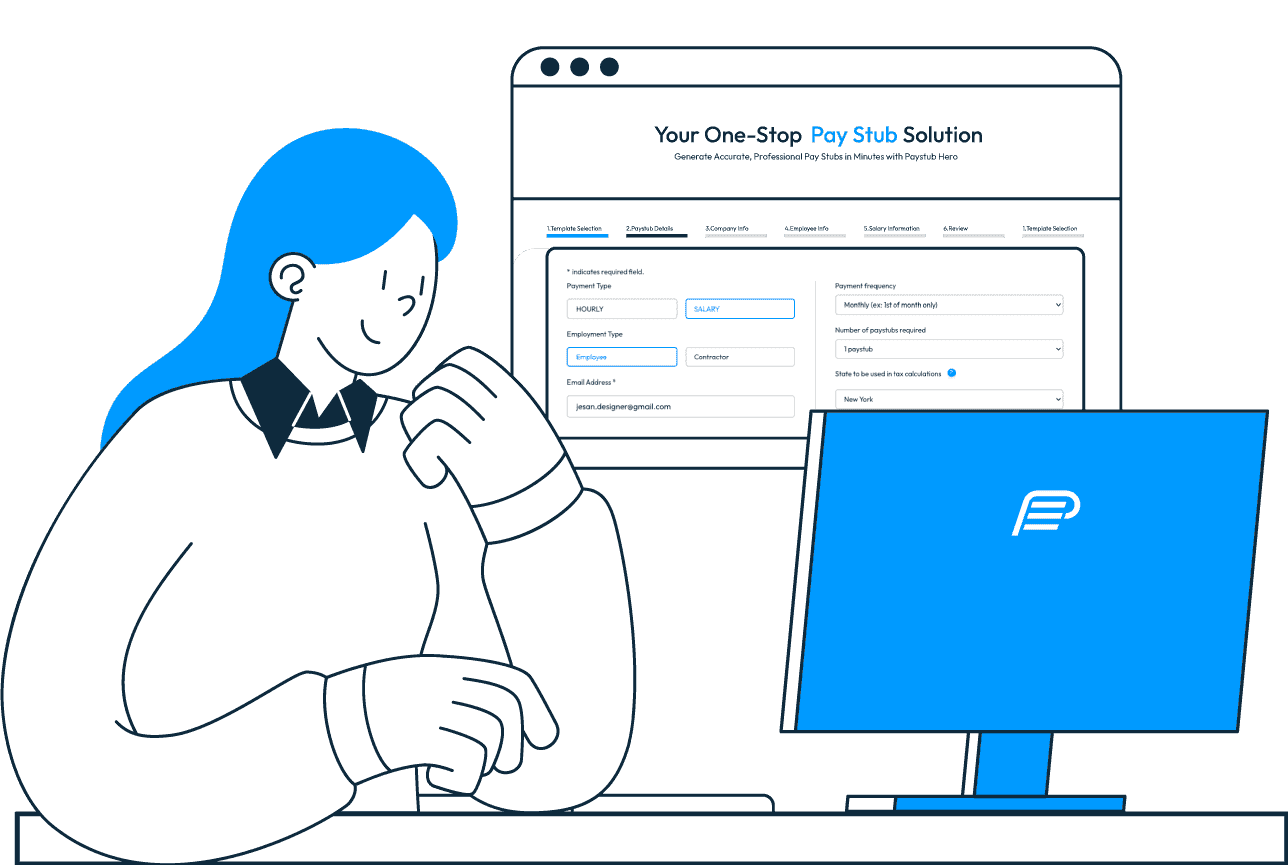

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

Decoding the 1099 Self Employed Form

The 1099 self-employed form, officially known as the 1099-NEC (Nonemployee Compensation), is a critical document for the US tax system, particularly for those operating outside traditional employment. This form is used by freelancers, independent contractors, and small business owners to report income earned from self-employment activities to the Internal Revenue Service (IRS).

The significance of the 1099 self-employed form lies in its role in ensuring tax compliance. It details the income an individual receives from various clients throughout the tax year, serving as a key record for accurate tax reporting. Unlike traditional employees, who have taxes withheld from their paychecks, self-employed individuals are responsible for reporting and paying their taxes, including self-employment tax, which covers Social Security and Medicare taxes.

Understanding and accurately filling out the 1099 form is essential. It requires detailed information such as the payer’s and payee’s legal names, addresses, Taxpayer Identification Numbers (TINs), and the total amount paid during the year. This form does not include withholdings for federal or state taxes, placing the onus on the self-employed individual to calculate and remit these taxes.

Filing the 1099 self-employed form is not just about compliance; it also impacts future Social Security benefits, as these are calculated based on reported earnings. Moreover, the IRS uses this form to cross-check reported income, making accuracy paramount to avoid audits and penalties.

For self-employed individuals navigating the complexities of tax reporting, understanding the 1099 form is a step towards financial responsibility and independence. It’s a declaration of their entrepreneurial spirit and a testament to their contribution to the economy. PayStubHero’s platform simplifies this process, ensuring that self-employed professionals can focus on their business, not just their taxes.

Navigating the Complexities of 1099 Self Employed Forms

The process of managing 1099 self-employed forms presents a significant challenge, especially for those new to self-employment. The primary hurdle lies in understanding the intricate tax laws and ensuring accurate reporting of income. Errors or omissions in these forms can lead to IRS audits and hefty penalties, creating a stressful financial situation. Additionally, keeping abreast of the ever-evolving tax regulations demands time and effort, often diverting attention from core business activities. This complexity not only intimidates many self-employed individuals but also increases the risk of non-compliance, making the need for a simplified, reliable solution more evident than ever.

Streamlining Tax Compliance with PayStubHero

Addressing the challenges of 1099 form management, PayStubHero emerges as a robust solution, specifically designed to ease the burden for self-employed individuals. Our platform simplifies the creation and management of 1099 self-employed forms, making tax compliance straightforward and less time-consuming. By automating the form-filling process and ensuring adherence to the latest tax regulations, PayStubHero minimizes the risk of errors and IRS audits. This not only alleviates the stress associated with tax reporting but also allows self-employed professionals to focus more on growing their business, confident in their financial and tax compliance. With PayStubHero, accurate and efficient tax reporting is no longer a hurdle but a seamless part of business operations.

Exclusive Features of PayStubHero's 1099 Self Employed Form Generator

PayStubHero’s 1099 self-employed form generator is not just a tool; it’s a comprehensive solution designed to transform the way self-employed professionals handle their tax reporting. Our platform is equipped with a range of features tailored to meet the unique needs of freelancers, contractors, and small business owners.

Firstly, the user-friendly interface ensures ease of navigation, making form generation accessible to everyone, regardless of their tech-savviness. The automated calculations eliminate the hassle of manual computations, reducing the likelihood of errors that could lead to IRS complications.

Moreover, our platform is constantly updated to align with the latest tax laws, ensuring that every form you generate is compliant and up-to-date. This feature is particularly valuable in a landscape where tax regulations are frequently changing.

Security is another cornerstone of our service. We understand the sensitivity of financial data, and our platform employs advanced security measures to protect your information. This commitment to confidentiality and data protection offers peace of mind, knowing your personal and financial details are secure.

Easy-to-Use Interface

Experience seamless form generation with our intuitive interface, designed for efficiency and ease of use. Whether you're tech-savvy or new to online tools, creating your 1099 form is straightforward and hassle-free.

Accurate Calculations

Say goodbye to manual calculations. Our automated system ensures that all your figures are accurately computed, reducing the risk of errors and ensuring peace of mind when it comes to IRS submissions.

Up-to-Date Compliance

Stay ahead of the curve with our constantly updated platform. We keep track of the latest tax laws and regulations, ensuring that every form you generate meets current IRS standards.

Secure and Confidential

Trust in our robust security measures. We prioritize the confidentiality and protection of your personal and financial information, providing a secure environment for all your tax reporting needs.

Enhancing Your Tax Experience with 1099 Self Employed Form Benefits

Discover the Advantages of Using PayStubHero for Your 1099 Self Employed Form Needs

Maximizing Efficiency with 1099 Self Employed Form Features

Unlock the Full Potential of PayStubHero for Your 1099 Self Employed Form Processing

Streamlined Process

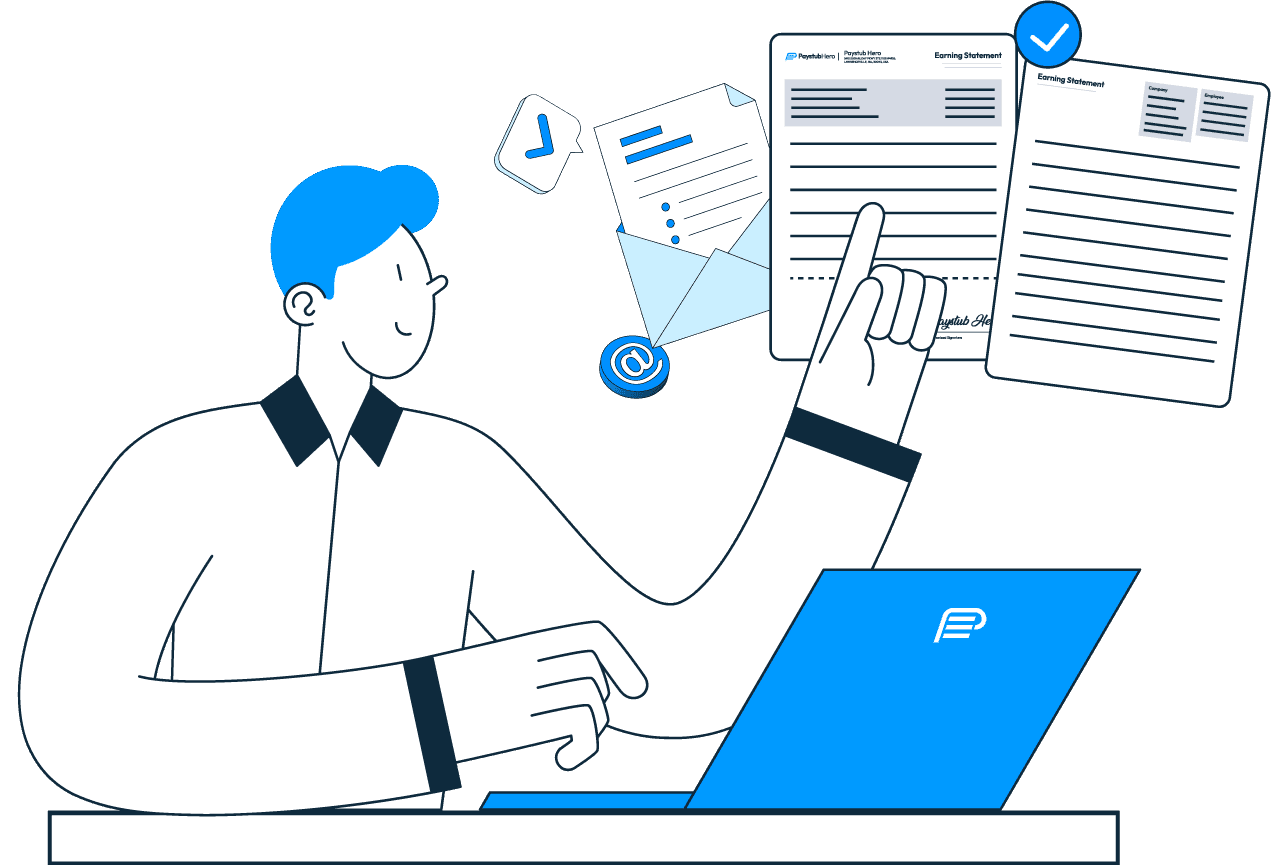

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Mastering the 1099 Form Texas Creation with Paystub Hero

A Step-by-Step Guide to Effortlessly Generate Your 1099 Form Texas

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate 1099

Instantly create a digital copy.

4. Download

Access your 1099 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

The 1099 self-employed form, specifically the 1099-NEC, is an IRS tax form used by self-employed individuals, freelancers, and independent contractors to report income earned from their services. This form is crucial for anyone who has earned income outside of traditional employment and needs to report it for tax purposes. It's not just for those who consider themselves 'business owners'; even if you've done freelance work or side gigs, this form is likely applicable to you. Understanding when and how to use this form is essential for accurate tax reporting and avoiding potential penalties.

The 1099 self-employed form plays a significant role in how you calculate and pay your taxes. The income reported on this form is subject to self-employment tax, which covers Social Security and Medicare taxes. Unlike traditional employees, where these taxes are automatically withheld, self-employed individuals must calculate and pay these taxes themselves. This form helps you determine the amount of income subject to tax and is essential for preparing your tax return accurately.

Yes, you can file your 1099 self-employed form electronically, and it is a secure method. Electronic filing (e-filing) is not only faster but also more secure than paper filing. When you use a service like PayStubHero, your data is encrypted and transmitted securely to the IRS. E-filing also provides immediate confirmation that your form has been received and processed, adding an extra layer of reassurance.

Failing to file a 1099 self-employed form can result in significant penalties from the IRS. These penalties can vary based on how late the form is filed and the amount of income that was not reported. The longer the delay in filing, the higher the penalty can be. Additionally, if the IRS believes the failure to file was intentional, more severe penalties, including criminal charges, could be imposed.

PayStubHero ensures accuracy through a combination of automated calculations and up-to-date tax compliance checks. Our platform uses the latest tax information and guidelines to help you fill out your form correctly. The automated system reduces the risk of human error in calculations, and our compliance checks ensure that your form meets all current IRS requirements.

If you realize you've made a mistake on your 1099 form after submitting it, it's important to correct it as soon as possible. You can file a corrected form, known as a 1099-NEC correction, to amend the information. It's crucial to do this promptly to avoid potential penalties and ensure your tax records are accurate. PayStubHero can assist in generating a corrected form with the right information.

Yes, maintaining accurate records and documents for your 1099 self-employed income is vital. Keep detailed records of all income received, including invoices, contracts, and payment receipts. It's also helpful to keep track of any expenses related to your self-employment, as these can be deductible. Good record-keeping makes it easier to fill out your 1099 form accurately and can be invaluable in case of an IRS audit.

PayStubHero is equipped to handle state-specific requirements for the

1099 self-employed form. Our platform is updated regularly to align with the varying regulations and filing requirements of different states. This means that whether you're dealing with state-specific tax rates, additional state forms, or unique filing deadlines, PayStubHero ensures that your 1099 forms are compliant with your state's tax laws. This feature is particularly beneficial for users who work across multiple states, providing a one-stop solution for all their state-specific tax reporting needs.

Absolutely. PayStubHero offers the flexibility to file 1099 forms for both the current and previous tax years. This feature is especially useful if you need to catch up on your tax filings or if you discover that you overlooked reporting certain income in the past. Our platform provides the necessary templates and guidelines for different tax years, ensuring that your late filings are still accurate and compliant with the tax laws of the respective years.

PayStubHero prides itself on offering exceptional customer support. Our team of knowledgeable professionals is available to assist with any queries related to the 1099 self-employed form. Whether you need guidance on how to fill out the form, have questions about specific tax situations, or require technical support with our platform, our customer service team is ready to provide timely and helpful assistance. We understand the complexities of tax reporting and are dedicated to making the process as smooth and stress-free as possible for our users.