🚀 California W2 Form

California W2 Form Generation Made Easy

Effortless California W2 Form Creation for Businesses and Individuals

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

PaystubHero has solutions to All Your document needs

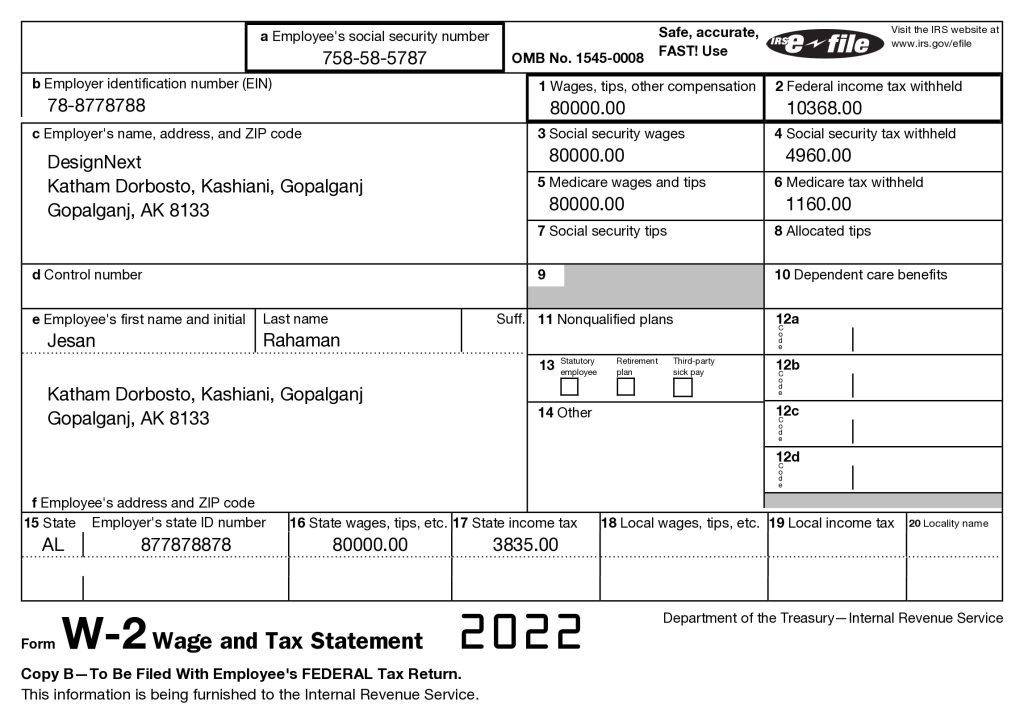

Understanding the California W2 Form

The W2 form, often referred to as the “Wage and Tax Statement,” stands as a cornerstone document for employees across the United States. It serves a dual purpose: firstly, to provide a comprehensive breakdown of an employee’s annual earnings, and secondly, to detail the taxes that have been withheld from their paycheck throughout the year. This form is not just a mere statement; it plays a pivotal role during the tax filing season, acting as a reference for employees to determine if they owe additional taxes or are eligible for a tax refund.

In the state of California, the significance of the W2 form is further amplified. Employers are legally mandated to issue this form to both their employees and the Internal Revenue Service (IRS). This ensures a transparent and consistent reporting of income, helping the state maintain an organized tax system. Moreover, the W2 form in California is tailored to align with the state’s specific tax laws and regulations, making it essential for employers and employees alike to understand its nuances and ensure its accurate completion.

By having a clear grasp of the W2 form, individuals can navigate the tax season with confidence, ensuring they are compliant with California’s tax obligations and are equipped with the necessary documentation to optimize their tax returns.

Challenges with Traditional California W2 Form Generation

In today’s fast-paced business environment, generating accurate W2 forms remains a significant challenge for many. Traditional methods often involve manual data entry, which is not only time-consuming but also prone to human errors. This can lead to discrepancies in reported income and taxes, potentially resulting in penalties from tax authorities. Additionally, staying updated with California’s ever-evolving tax laws and regulations adds another layer of complexity. For businesses, especially smaller ones without dedicated accounting teams, these challenges can divert valuable resources away from core operations, hindering growth and efficiency.

Streamlined California W2 Form Creation with Paystub Hero

Navigating the intricacies of W2 form generation doesn’t have to be a daunting task. Enter Paystub Hero, a beacon of simplicity in a sea of complexity. Our platform is designed to address the challenges faced by businesses and individuals head-on. With a few clicks, users can generate W2 forms that are accurate, compliant with California tax laws, and ready for submission. Gone are the days of manual calculations and the anxiety of potential errors. With Paystub Hero, you gain access to a system that prioritizes precision, speed, and user experience. Whether you’re a business owner juggling multiple tasks or an individual seeking a hassle-free solution, Paystub Hero is your trusted partner in seamless W2 form generation.

Why Choose Paystub Hero for Your California W2 Form Needs?

In the realm of online document generation, Paystub Hero stands out as a paragon of excellence. Our platform is meticulously crafted to cater to the unique needs of businesses and individuals alike. We understand the importance of accuracy, especially when it comes to financial documents like the W2 form. But our commitment doesn’t stop at just providing accurate forms; we aim to offer a holistic experience that makes the entire process smooth, efficient, and user-friendly.

Accuracy Guaranteed

In the world of tax documentation, there's no room for error. Paystub Hero's advanced algorithms ensure that every calculation, every detail, is spot-on. Our system undergoes regular updates to stay aligned with California's tax laws, ensuring that your W2 forms are not only accurate but also compliant.

Fast Turnaround

Time is of the essence, especially for businesses with tight schedules. Our platform is designed for speed, allowing you to generate your W2 forms in mere minutes. No more waiting, no more delays; with Paystub Hero, you get what you need when you need it.

Compliant with CA Laws

California's tax landscape is dynamic, with laws and regulations evolving over time. Our team stays abreast of these changes, ensuring that Paystub Hero's platform is always up-to-date. This proactive approach guarantees that your W2 forms meet all state-specific requirements.

Exceptional Support

At Paystub Hero, we believe that our relationship with our users extends beyond just providing a service. Our dedicated customer support team is always at the ready, eager to assist you with any queries or concerns. Whether you're a first-time user or a seasoned client, we're here to ensure your experience is seamless.

*10% discount going on for the first time. Use coupon code: WELCOME10

Unparalleled Advantages of Using Paystub Hero for Your California W2 Form Needs

Elevate Your California W2 Form Generation Experience with Our Distinctive Features

Maximizing Value with Our California W2 Form Solutions

Discover the Unique Perks of Choosing Paystub Hero for Your California W2 Form Needs

Streamlined Process

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Step-by-Step Guide to Creating a W2 Form Image

Follow our simple step-by-step process

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate W2

Instantly create a digital copy.

4. Download

Access your W2 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just Only $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Invoice

$11.99

/ Per Invoice

Unbeatable Value at Just Only $11.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Offer Letter

$12.99

/ Per Offer Letter

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

We've Helped 839,492 Customers Create Their Paystub Template Using Our Stub Generator

Get your questions answered

The California W2 form, also known as the "Wage and Tax Statement," is a crucial document that provides a detailed account of an employee's annual earnings and the taxes withheld from their paycheck. It's essential for tax filing purposes, helping employees and employers maintain transparency and compliance with state tax regulations.

Paystub Hero utilizes advanced algorithms and regularly updated tax tables specific to California. This ensures that every detail, from income calculations to tax withholdings, is precise and compliant with the latest state regulations.

Absolutely. Paystub Hero prioritizes user data security. We employ state-of-the-art encryption methods to safeguard your information, ensuring that your California W2 form details remain confidential and protected at all times.

Our platform is designed for efficiency. Once you input the necessary details, you can generate your California W2 form in just a few minutes, ensuring you meet any deadlines without stress.

Paystub Hero boasts a dedicated customer support team ready to assist you. Whether you have queries about the form itself or the generation process, our experts are just a click away to ensure a seamless experience.

No. Paystub Hero believes in transparency. Our pricing is upfront, with no hidden fees. You pay for what you see, ensuring you get the best value for your money.

Our team continuously monitors updates and changes to California's tax laws. This proactive approach ensures that our platform is always aligned with the latest state-specific requirements, guaranteeing compliant and accurate California W2 forms.

Yes, Paystub Hero is equipped to handle bulk requests. Whether you're a small business or a large corporation, our platform can efficiently generate multiple California W2 forms, saving you time and effort.

Paystub Hero combines accuracy, speed, user-friendliness, and exceptional support. Our platform is tailored to offer a holistic experience, ensuring that every user, whether an individual or a business, finds the process straightforward and efficient.

No special software is required. Once your California W2 form is generated, you can easily download it in a universally accessible format and print it directly, ensuring convenience at every step.