🚀 Contractor 1099 Form

Effortlessly Generate Your Contractor 1099 Form

Streamline Your Tax Reporting with Our Contractor 1099 Form Solution

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

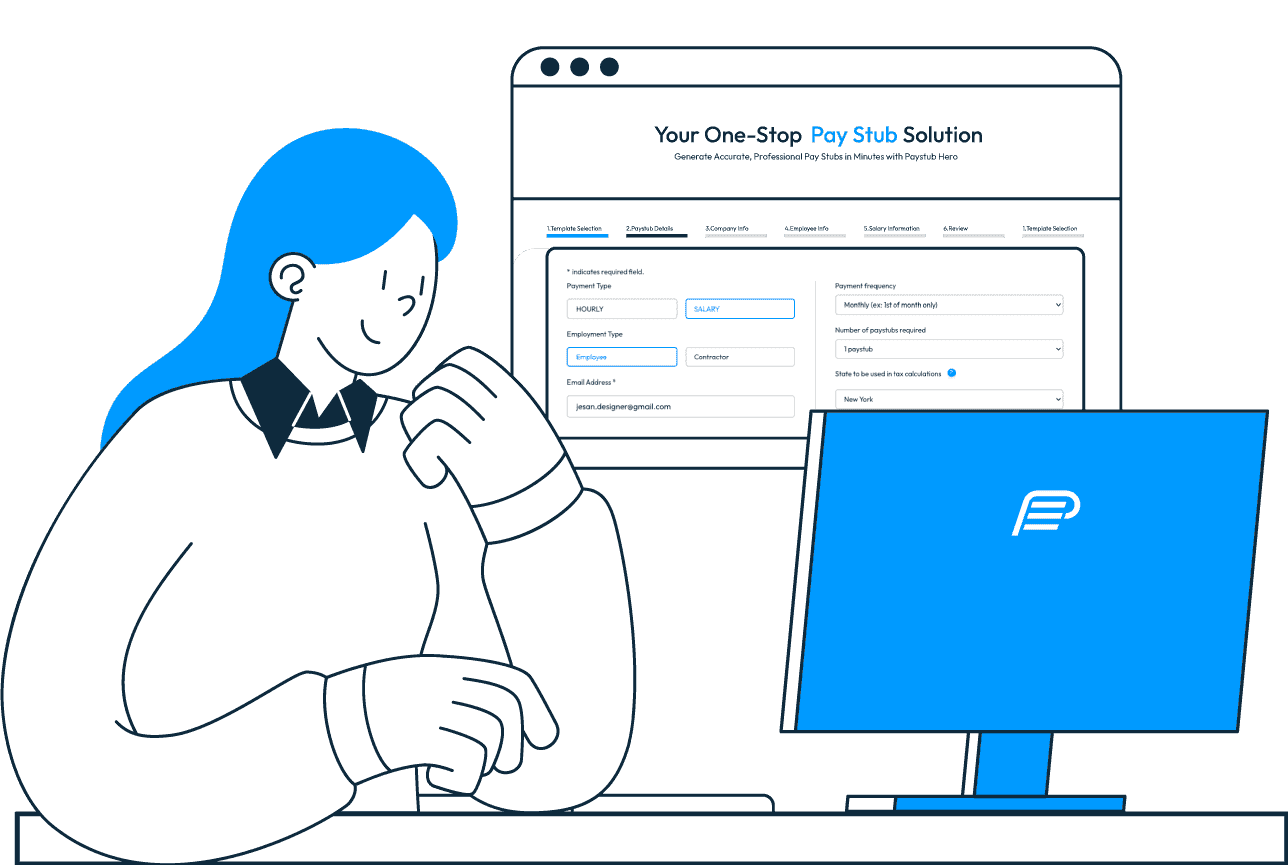

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

Understanding the Contractor 1099 Form in Detail

The Contractor 1099 Form, officially known as Form 1099-NEC (Nonemployee Compensation), plays a pivotal role in the United States tax system, particularly for businesses and independent contractors. This form is utilized by businesses to report payments exceeding $600 in a year to individuals who are not their employees, typically independent contractors, freelancers, or self-employed individuals.

The significance of the 1099 form lies in its function as a critical tool for the IRS to track income that might otherwise go unreported. For contractors, it’s an essential document that reflects their annual income from various clients, forming the basis for their income tax calculations. Unlike traditional employees, who have taxes withheld from their paychecks, independent contractors use the 1099 form to report their gross income and calculate their tax dues.

For businesses, issuing the 1099 form is not just a matter of compliance but also a responsibility. Failing to provide accurate and timely 1099 forms can lead to penalties and legal complications. It’s crucial for businesses to distinguish between an employee and a contractor, as this classification affects how they report payments to the IRS.

Moreover, the 1099 form has undergone changes, with the IRS reintroducing Form 1099-NEC in recent years to specifically address nonemployee compensation. This change aims to streamline the reporting process and ensure better compliance with tax laws.

In summary, the Contractor 1099 Form is a fundamental document that ensures transparency and accountability in the financial dealings between businesses and independent contractors. It’s a testament to the growing gig economy and the shifting dynamics in the workforce, emphasizing the importance of accurate tax reporting in the modern economic landscape.

Navigating the Complexities of 1099 Form Management

Businesses often face significant challenges in managing Contractor 1099 Forms. The process, fraught with complexities, requires meticulous attention to detail and an understanding of tax laws. Many businesses struggle with accurately determining who qualifies as an independent contractor, leading to potential misclassification and subsequent legal repercussions. Additionally, the manual preparation and filing of these forms are time-consuming and prone to human error, increasing the risk of IRS penalties. This administrative burden is particularly heavy for small businesses and startups, which may lack the resources or expertise to efficiently handle these tasks. The need for a streamlined, error-free solution is evident in this landscape of regulatory intricacies and operational demands.

Streamlining 1099 Form Management with PayStubHero

Addressing the challenges of 1099 form management, PayStubHero emerges as a comprehensive solution, specifically designed to alleviate the complexities faced by businesses. Our platform simplifies the entire process of creating, managing, and filing Contractor 1099 Forms. By automating the form generation, PayStubHero minimizes the risks of errors and misclassification, ensuring compliance with IRS regulations. This not only saves valuable time but also reduces the administrative burden, particularly for small businesses and startups. Our user-friendly interface allows for quick data entry and management, making it accessible even for those with limited tax knowledge. Additionally, PayStubHero keeps up-to-date with the latest tax laws, providing peace of mind that your business stays compliant. In essence, PayStubHero offers a reliable, efficient, and hassle-free solution for managing Contractor 1099 Forms, transforming a traditionally complex task into a streamlined and error-free process.

Comprehensive Features of PayStubHero: Revolutionizing 1099 Form Management

PayStubHero is not just a tool; it’s a complete ecosystem designed to transform the way businesses handle Contractor 1099 Forms. Our platform is engineered to address the multifaceted challenges of 1099 form management, offering a suite of features that bring efficiency, accuracy, and compliance to the forefront. Here’s an in-depth look at the capabilities that set PayStubHero apart:

Automated Form Generation

PayStubHero's automated system streamlines the creation of 1099 forms, meticulously populating them with accurate data. This automation significantly reduces the time and effort involved in manual entries, virtually eliminating the risk of human error. The system is intuitively designed to ensure that all necessary information is correctly reported, thereby maintaining compliance with IRS guidelines.

Real-Time Compliance Updates

In the ever-evolving landscape of tax regulations, staying compliant is crucial. PayStubHero is equipped with a dynamic update system that keeps track of the latest tax laws and IRS requirements. This feature ensures that your 1099 forms are always in line with current regulations, safeguarding your business against potential legal complications and penalties.

Easy Multi-Contractor Management

Managing multiple contractors can be a daunting task, but PayStubHero simplifies this process. Our platform allows you to efficiently handle information and payments for numerous contractors in one centralized location. This feature is particularly beneficial for businesses with a diverse contractor base, enabling streamlined management and oversight.

Secure Data Protection

Understanding the sensitivity of financial data, PayStubHero employs robust security measures to safeguard your information. Our commitment to data protection ensures that all your transactions and contractor details are securely stored, maintaining the highest level of confidentiality and trust.

User-Friendly Interface

The PayStubHero platform is designed with user experience in mind. Its intuitive interface makes navigation and operation straightforward, even for those with limited technical expertise. This ease of use ensures that all users, regardless of their background, can efficiently manage their 1099 forms without any added stress.

Customizable Form Options

Every business has unique needs, and PayStubHero caters to this diversity with customizable form options. Whether you need to adjust for specific payment types or adhere to particular reporting standards, our platform offers the flexibility to tailor your 1099 forms to fit your specific business requirements.

Integrated Tax Calculations

Accurate tax calculations are integral to 1099 form management. PayStubHero automates these calculations, ensuring that the correct tax amounts are always reported. This feature not only aids in compliance but also streamlines the overall tax preparation process, making it more efficient and reliable.

Efficient Data Import and Export

PayStubHero facilitates seamless data integration, allowing you to easily import information from other systems and export completed forms for filing. This capability enhances the platform's utility, making it a versatile tool that fits into your existing workflow with minimal disruption.

Responsive Customer Support

At PayStubHero, we understand the importance of reliable support. Our team of experts is always on hand to assist with any queries or challenges you may encounter, ensuring a smooth and uninterrupted experience.

Regular Feature Updates

Our commitment to excellence is reflected in our continuous effort to improve and expand our features. Based on user feedback and market trends, we regularly update PayStubHero to meet the evolving needs of our clients, ensuring that our platform remains at the forefront of 1099 form management solutions.

In summary, PayStubHero’s comprehensive feature set is meticulously crafted to address every aspect of Contractor 1099 Form management. From ensuring accuracy and compliance to providing a user-friendly experience, PayStubHero stands as a beacon of innovation and efficiency in the realm of financial document management.

Maximizing Efficiency with Contractor 1099 Form Features

Discover the Advantages of Using PayStubHero for Your Contractor 1099 Form Needs

Elevate Your Business with Superior Contractor 1099 Form Solutions

Unlock the Full Potential of PayStubHero for Your Contractor 1099 Form Processing

Streamlined Process

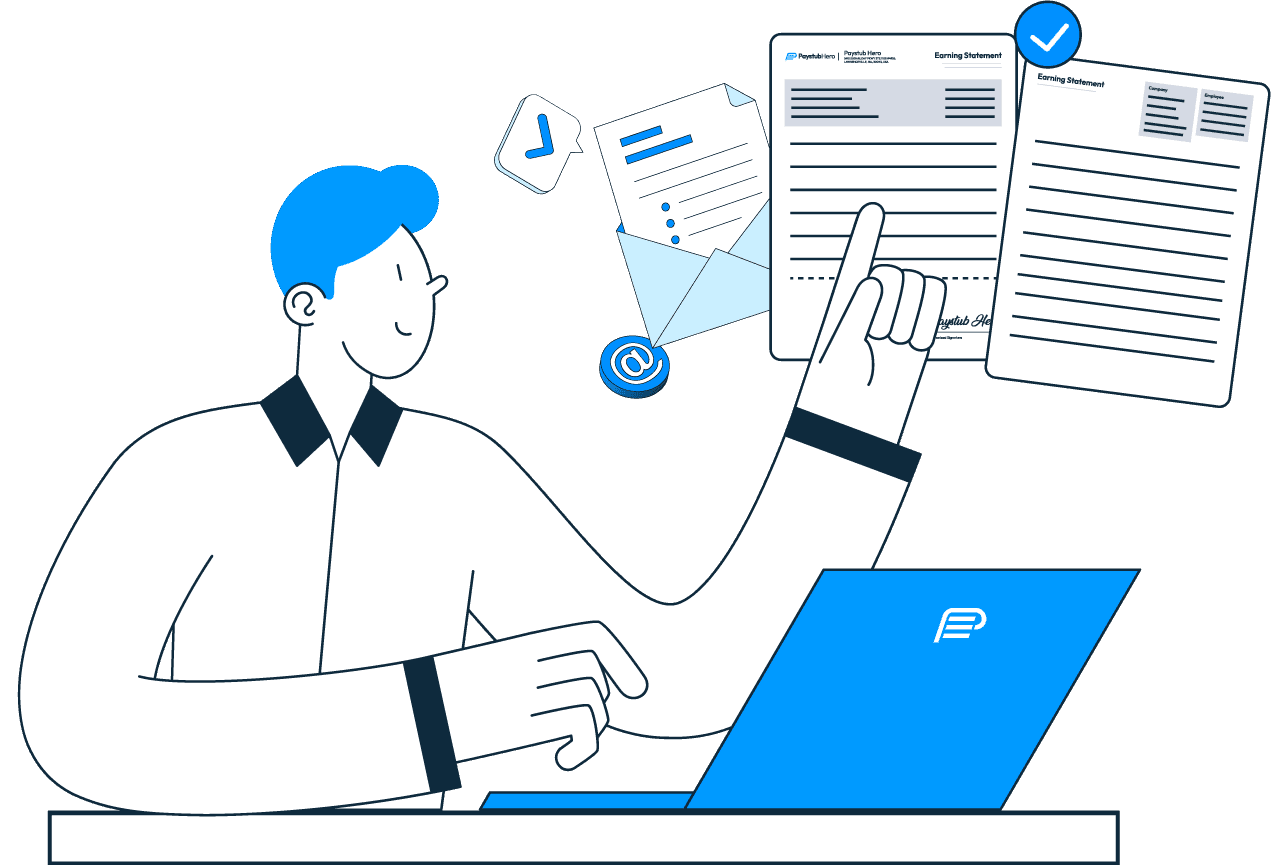

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Mastering the 1099 Form Texas Creation with Paystub Hero

A Step-by-Step Guide to Effortlessly Generate Your 1099 Form Texas

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate 1099

Instantly create a digital copy.

4. Download

Access your 1099 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

The Contractor 1099 Form, specifically Form 1099-NEC, is an IRS document used to report payments made to independent contractors. It's crucial for tax reporting, as it helps the IRS track income that might otherwise go unreported. For businesses, it's a legal requirement to issue this form for any contractor paid over $600 in a year. This form is vital for contractors to accurately report their income and for businesses to maintain tax compliance.

PayStubHero streamlines the creation of Contractor 1099 Forms through automation and a user-friendly interface. Our system accurately populates the forms with required data, reducing manual entry and the associated errors. This not only saves time but also ensures compliance with IRS regulations. Additionally, our platform can manage multiple contractors, making it easier for businesses to handle their tax reporting obligations efficiently.

Absolutely. PayStubHero is designed to be fully compliant with IRS regulations. We regularly update our system to reflect the latest tax laws and IRS guidelines. This ensures that the Contractor 1099 Forms generated through our platform meet all legal requirements, thereby protecting your business from potential penalties due to non-compliance.

Yes, PayStubHero is equipped to manage multiple contractors with ease. Our platform allows you to enter and store information for numerous contractors, streamlining the process of generating 1099 forms for each individual. This feature is particularly beneficial for businesses that work with a large number of contractors, simplifying what would otherwise be a complex and time-consuming process.

Filing incorrect Contractor 1099 Forms can lead to serious consequences, including penalties from the IRS. These penalties can vary depending on the nature of the error, such as incorrect amounts reported, missing information, or late filing. In severe cases, it can also lead to audits and legal scrutiny. Therefore, accuracy in 1099 form filing is crucial, and PayStubHero helps ensure this accuracy.

Data security is a top priority at PayStubHero. We employ advanced encryption and security protocols to ensure that all the data you enter into our system is protected. This includes personal and financial information of both your business and your contractors. We understand the importance of confidentiality in financial matters and are committed to maintaining the highest standards of data security.

Yes, PayStubHero provides customer support for tax-related queries. Our team of experts is knowledgeable about IRS regulations and 1099 form requirements. They are available to assist you with any questions or issues you may encounter while using our platform, ensuring a smooth and hassle-free experience.

PayStubHero is designed with flexibility in mind and can be integrated with various accounting and payroll systems. This integration capability allows for seamless data transfer, reducing the need for manual data entry and the potential for errors. Our goal is to make PayStubHero a versatile tool that fits easily into your existing business processes.

PayStubHero stays current with changing tax laws and regulations through continuous monitoring and regular updates. Our team closely follows IRS announcements and tax law changes to ensure that our platform is always compliant. This proactive approach means that you can trust PayStubHero to handle your Contractor 1099 Forms accurately, regardless of any changes in the tax landscape.

PayStubHero sets itself apart through its comprehensive features, ease of use, and commitment to compliance and security. Unlike other services, PayStubHero offers a blend of user-friendly design, advanced automation, and expert support. Our platform is not just a tool for generating forms; it's a complete solution for managing your contractor payments and tax reporting obligations efficiently and securely.