🚀 Form 1099 Instructions

Complete Guide to Form 1099 Instructions - Simplify Your Tax Filing

Understanding Form 1099 Instructions: A Step-by-Step Approach

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

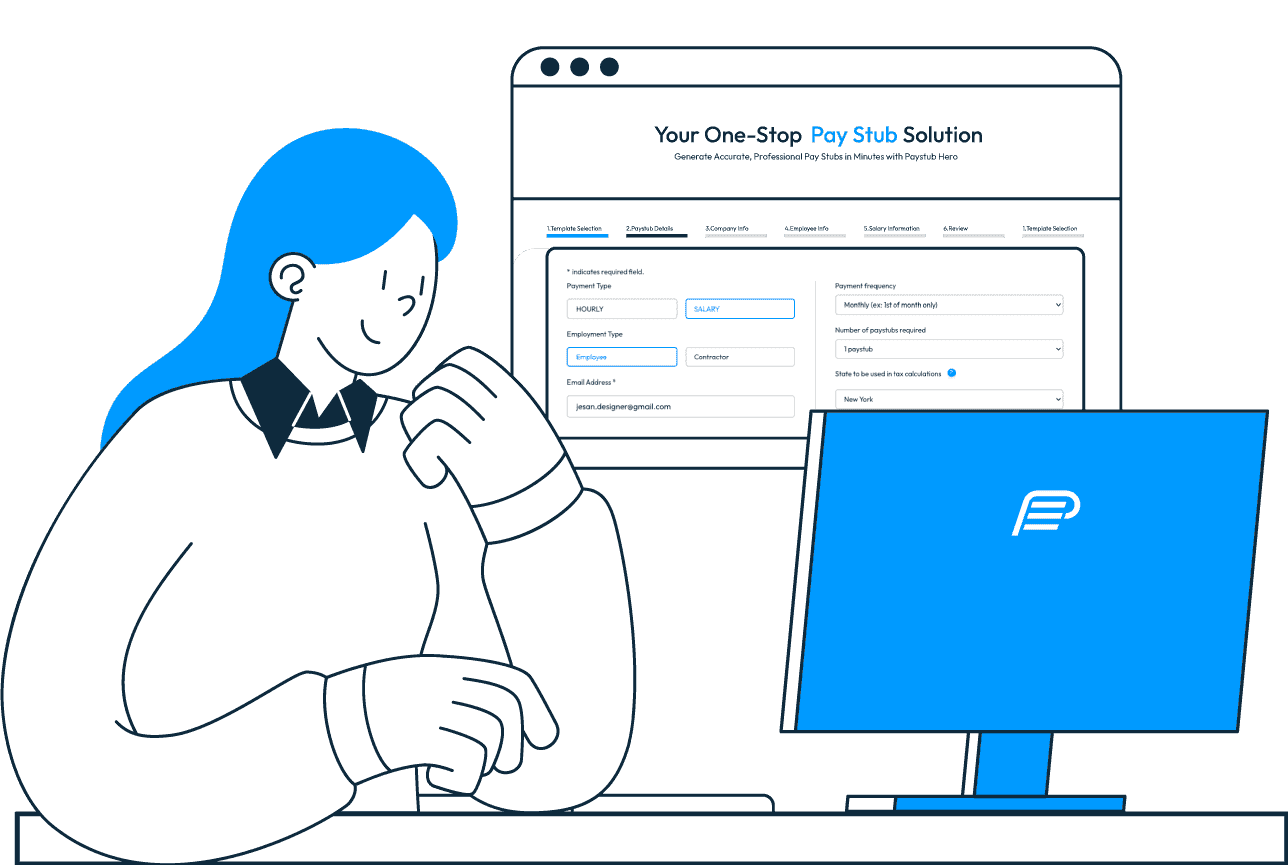

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

What is Form 1099: Essential Tax Document Explained

Form 1099 is a pivotal tax document in the United States, serving as a record for various types of income other than salary, wages, and tips. This form is particularly significant for freelancers, independent contractors, landlords, and small business owners who receive income that is not subject to automatic withholding tax. The IRS mandates the use of Form 1099 for reporting payments totaling over $600 in a fiscal year to a single payee.

There are several variants of Form 1099, each designed to report different types of income. For instance, Form 1099-MISC is used for miscellaneous income, while 1099-INT reports interest earnings. Understanding the specific form applicable to your situation is crucial for accurate tax reporting.

The importance of Form 1099 extends beyond mere reporting; it plays a vital role in ensuring tax compliance and accuracy in income declaration. It helps the IRS track income sources not directly reported by employers, thereby closing gaps in tax collection and ensuring a fair tax system. For the recipient, it provides a clear record of income earned from various sources, which is essential for accurate tax return preparation and avoiding penalties associated with underreporting income.

Navigating the intricacies of Form 1099 can be challenging, especially with the IRS’s regular updates to tax laws and reporting requirements. It’s not just about knowing which form to use, but also understanding the deadlines, the specific information required, and the implications of the data provided. This is where PaystubHero’s services become invaluable, offering a simplified, user-friendly solution for generating and managing Form 1099 with ease and precision.

Navigating the Complexities of Form 1099

The process of managing and filing Form 1099 poses significant challenges, especially for small businesses and independent professionals. The primary issue lies in understanding the diverse requirements for different types of 1099 forms, which can be overwhelming. Additionally, keeping up with the IRS’s changing regulations and deadlines adds to the complexity. Errors in filing, such as incorrect or late submissions, can lead to penalties and compliance issues. This complexity often results in confusion and apprehension, making the task of tax reporting a daunting endeavor for many.

Streamlining Form 1099 Filing with PaystubHero

PaystubHero addresses the complexities of Form 1099 filing with an intuitive, user-friendly online platform. Our solution simplifies the creation and management of various 1099 forms, catering to the specific needs of freelancers, small businesses, and accountants. By automating the process, we minimize the risk of errors and ensure compliance with the latest IRS regulations. Our platform not only saves valuable time but also provides peace of mind by making the filing process more transparent and manageable. With PaystubHero, users can confidently navigate the intricacies of tax reporting, ensuring accuracy and timeliness in their submissions.

Key Features of Our Form 1099 Generator

PaystubHero’s Form 1099 generator is designed with a suite of features to cater to the diverse needs of our users, ensuring a seamless and error-free tax filing experience. Our platform integrates advanced technology with user-centric design, offering a range of functionalities that streamline the entire process of managing and filing Form 1099.

Automated Calculations

At the heart of our platform is the automated calculation feature, which meticulously computes all necessary figures, ensuring accuracy and consistency in your tax documents. This automation significantly reduces the likelihood of manual errors, a common issue in tax preparation, thereby saving time and enhancing reliability in your submissions.

Customizable Templates

Understanding that each user's needs are unique, we offer a range of customizable templates. These templates are designed to be flexible and adaptable, allowing users to tailor their Form 1099 according to their specific income types and reporting requirements. This level of customization is particularly beneficial for users with multiple income streams or those who require specific reporting formats.

Secure Data Handling

In an era where data security is paramount, PaystubHero prioritizes the protection of your sensitive financial information. Our platform employs state-of-the-art security measures, including advanced encryption and secure server protocols, to safeguard your data against unauthorized access and potential security threats. This commitment to security ensures that your financial information remains confidential and secure at all times.

Real-Time Support

To complement our technological offerings, PaystubHero provides real-time support from our team of experts. Whether you need assistance in navigating the platform, understanding specific features, or addressing any queries related to Form 1099, our dedicated support team is readily available to provide guidance and support. This ensures a seamless and stress-free experience for all users, regardless of their level of expertise in tax preparation.

In summary, PaystubHero’s Form 1099 generator is not just a tool for tax preparation; it’s a comprehensive solution designed to simplify and streamline the entire process of managing and filing tax documents. With its blend of automation, customization, security, and support, the platform stands out as an invaluable resource for individuals and businesses seeking an efficient and reliable way to handle their tax reporting needs.

Maximizing Benefits with Form 1099 Instructions Compliance

Leveraging Form 1099 Instructions for Optimal Tax Reporting Efficiency

Enhancing Your Tax Filing Experience with Form 1099 Instructions

Discover the Advantages of Accurate Form 1099 Instructions Compliance

Streamlined Process

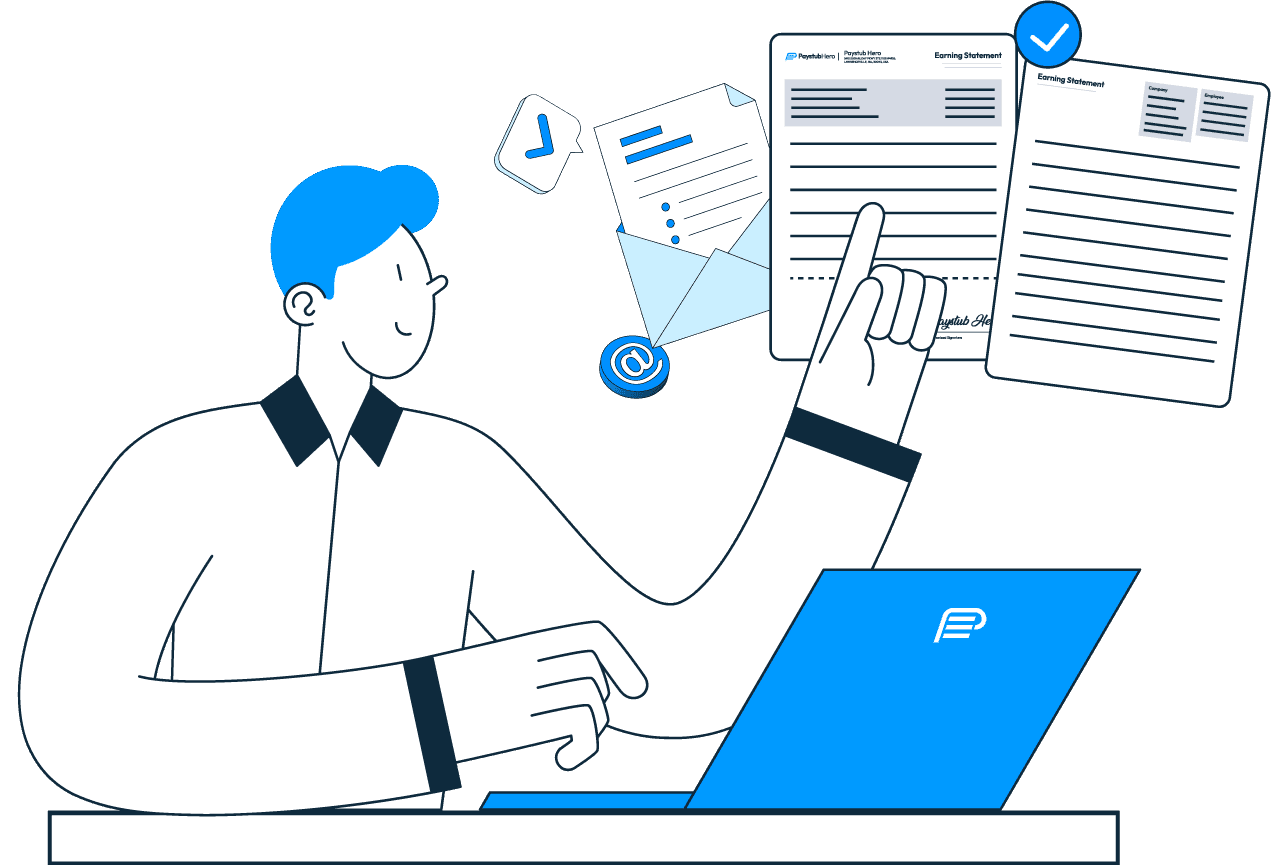

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Mastering the 1099 Form Texas Creation with Paystub Hero

A Step-by-Step Guide to Effortlessly Generate Your 1099 Form Texas

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate 1099

Instantly create a digital copy.

4. Download

Access your 1099 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

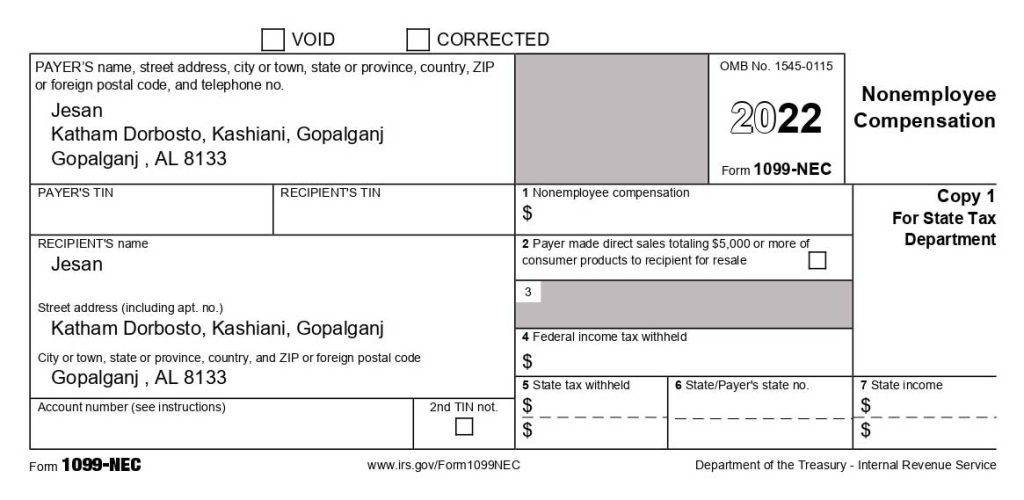

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

Form 1099 is a series of IRS tax documents used to report various types of income other than wages, salaries, and tips. It's essential for businesses and individuals who make certain types of payments, including freelance income, interest, dividends, and more. If you've made payments totaling more than $600 in a year to a non-employee, you're typically required to file a Form 1099. This form is crucial for accurate tax reporting and compliance with IRS regulations.

There are several types of Form 1099, each designed for specific reporting purposes. For example, Form 1099-MISC is used for miscellaneous income, 1099-INT for interest income, 1099-DIV for dividends and distributions, and 1099-R for distributions from pensions, annuities, retirement plans, etc. Each form serves to report different types of income to the IRS, ensuring that all taxable income is accounted for during tax season.

You need to issue a Form 1099 if you've paid at least $600 during the year in rent, services performed by a non-employee, prizes and awards, or other income payments. This requirement is part of your tax obligations and helps the IRS track income that might not be subject to withholding. It's important to consult with a tax professional if you're unsure about your reporting obligations.

The deadlines for filing Form 1099 can vary depending on the specific form. Generally, you must send the form to the recipient by January 31st and file it with the IRS by the last day of February (if filing by paper) or by March 31st (if filing electronically). It's crucial to adhere to these deadlines to avoid penalties for late filing.

Form 1099 can be obtained from the IRS website or through tax software programs. Alternatively, you can order the forms from the IRS, or pick them up at an IRS office or a local office supply store. It's important to use the correct version of the form, as the IRS updates them annually.

To fill out Form 1099, you'll need the recipient's name, address, taxpayer identification number (TIN), and the total amount paid during the year. You'll also need to classify the type of payment made. Accurate record-keeping throughout the year is crucial to ensure that the information reported on Form 1099 is correct.

The penalties for not filing Form 1099 can range from $50 to $270 per form, depending on how late the form is filed. If the IRS determines that you intentionally disregarded the filing requirement, the penalty can be $550 per form or 10% of the income reported, with no maximum limit. These penalties underscore the importance of timely and accurate filing.

Yes, you can file Form 1099 electronically through the IRS Filing Information Returns Electronically (FIRE) system. Electronic filing is recommended for efficiency and accuracy, and it's required for businesses filing 250 or more forms. The IRS provides guidelines and resources on their website to assist with electronic filing.

If you receive a Form 1099 with incorrect information, you should contact the issuer immediately to request a corrected form. It's important to address any discrepancies before filing your tax return to avoid potential issues with the IRS.

PaystubHero simplifies the process of managing and filing Form 1099. Our platform offers features like automated calculations, customizable templates, and secure data handling, making it easier to generate accurate and compliant forms. Additionally, our real-time support ensures that you have expert assistance throughout the process, making tax reporting efficient and stress-free.