🚀 Paystub for Mortgage

Ultimate Paystub for Mortgage Solution: Streamline Your Home Financing Journey

Experience the Power of a Reliable Paystub for Mortgage – Fast, Secure, and Tailored for Your Needs

- Apartment Leasing Process

- Mortgage Qualification

- Small Business Loan Request

- Income Verification for Dependents Support

- Health Insurance Application Process

- Empower Employee Finance

- Uphold Employment Laws

- Transparent Pay

- Auto Pay Stub Calculation

- Payroll Document Management

PaystubHero has solutions to All Your document needs

Understanding Paystub for Mortgage: Your Financial Passport to Homeownership

When I first dipped my toes into the mortgage world, I quickly learned that a well-crafted paystub for mortgage isn’t just a piece of paper—it’s your golden ticket to financial credibility. Picture this: you’re at the grocery store, and the cashier asks for a loyalty card; similarly, lenders demand a clear snapshot of your income to ensure you’re the right candidate for that shiny new home. The paystub for mortgage details your gross earnings, deductions, and net income, acting as a reliable proof of your financial stability.

I remember the nerve-wracking days of gathering endless, outdated documents from various sources—each one prone to errors and misprints. It felt like trying to solve a jigsaw puzzle in the dark. Then came the online revolution! Today, with a few clicks on PaystubHero, you can generate a professional, accurate paystub for mortgage in minutes. It’s like having a digital genie who grants your financial wishes without any fuss or delays. This simple yet powerful document not only streamlines your application process but also builds trust with lenders. In our fast-paced world, where time is money, having an impeccable paystub for mortgage is a game-changer that turns the stressful into the seamless.

Navigating Document Dilemmas in a Complex Market

Imagine trying to order your favorite burger, only to receive a mystery sandwich instead—frustrating, right? That’s what many face when submitting a jumble of outdated documents to lenders. Without a reliable paystub for mortgage, the mortgage application process becomes as clumsy as a bull in a china shop. Lenders crave clear, concise financial proof, and when you’re stuck with error-ridden paperwork, trust and speed are lost in translation. This market problem isn’t just a minor hiccup; it’s a major stumbling block that leaves potential homeowners scrambling and overwhelmed.

Innovative Solutions to Overcome Financial Hurdles

Enter the modern solution: an online paystub for mortgage generator that takes the headache out of paperwork. Think of it as upgrading from dial-up internet to fiber-optic speed. With PaystubHero, you simply input your income details, and voilà—a professional, compliant paystub for mortgage is generated in seconds. This streamlined process cuts out the tedious back-and-forth with your lender, eliminating errors and reducing stress. It’s the digital equivalent of having your cake and eating it too, making the mortgage application process not only faster but also a lot less nerve-racking.

Features of Our Paystub for Mortgage Generator: Unmatched Precision and Ease-of-Use

Our advanced online generator is designed to simplify your mortgage documentation process while ensuring that every detail of your paystub for mortgage is accurate, compliant, and professionally formatted. With our state-of-the-art technology, you can generate a document that meets the strictest standards required by lenders, all within a matter of seconds. Enjoy a seamless experience with intuitive navigation, real-time data validation, and robust security protocols, making your journey to homeownership less stressful and more efficient.

User-Friendly Interface

Experience an intuitive design that makes generating your paystub for mortgage as effortless as clicking a button, reducing the learning curve and saving you time.

Rapid Processing Speed

Benefit from near-instantaneous document creation, allowing you to move swiftly through your mortgage application without unnecessary delays.

Unparalleled Accuracy

Every figure is meticulously verified to ensure your paystub for mortgage reflects precise financial information, enhancing lender confidence and application credibility.

Enhanced Security Measures

Your sensitive data is safeguarded with cutting-edge encryption and stringent security protocols, providing peace of mind throughout the document generation process.

*10% discount going on for the first time. Use coupon code: WELCOME10

Benefits of a Professional Paystub for Mortgage

Empowering Your Mortgage Application

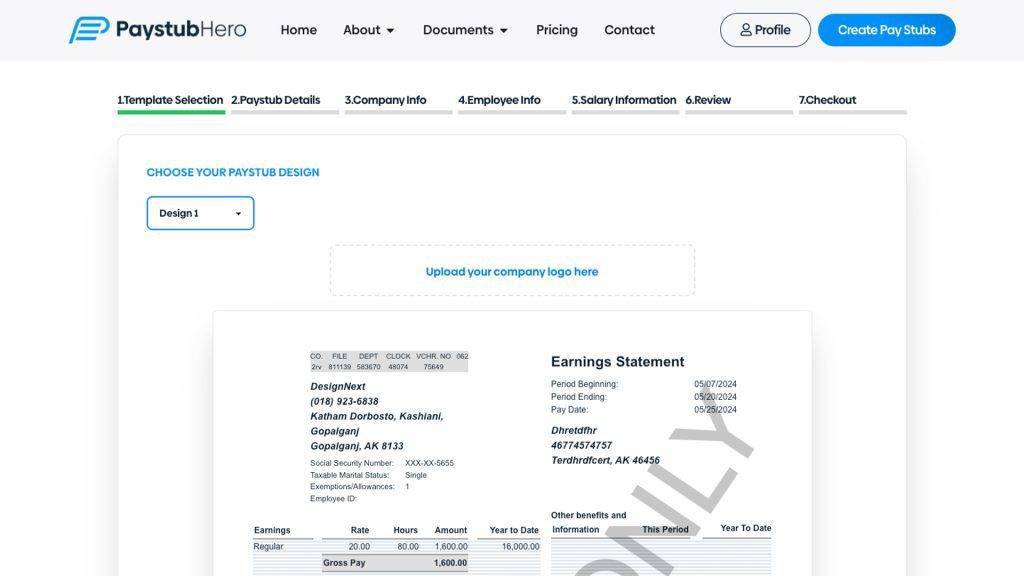

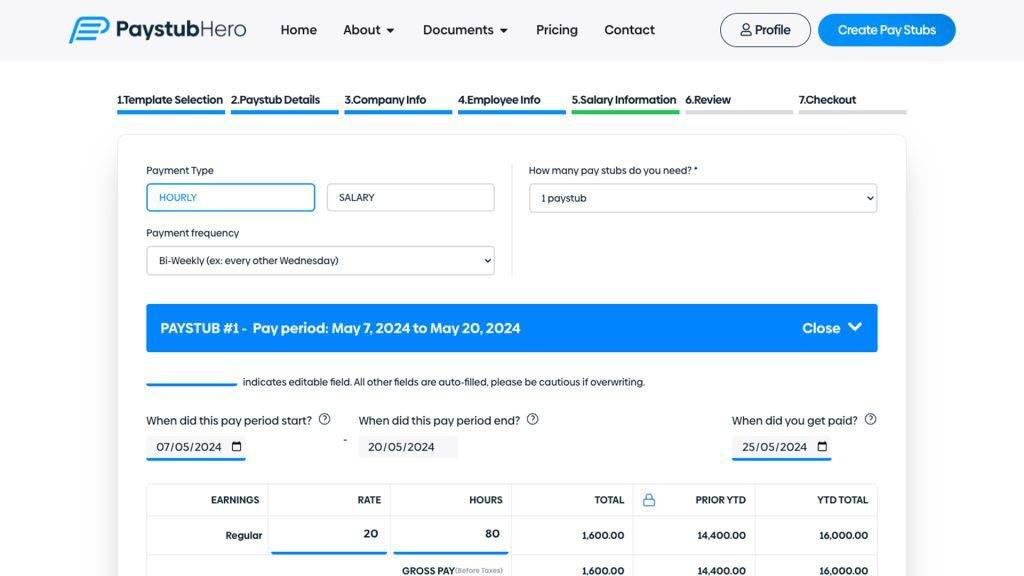

How to use our Paystub Generator?

Choose a pay stub template from our 6 designs

Enter Information such as company name, your work schedule and salary details

Download your paycheck stubs directly from your email in PDF format

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just Only $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Invoice

$11.99

/ Per Invoice

Unbeatable Value at Just Only $11.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Offer Letter

$12.99

/ Per Offer Letter

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

We've Helped 839,492 Customers Create Their Paystub Template Using Our Stub Generator

Frequently Asked Questions About Paystub for Mortgage

A paystub for mortgage is a detailed financial document that provides lenders with a clear snapshot of your income, including gross earnings, deductions, and net pay. It acts as a cornerstone of your mortgage application, ensuring that your financial credentials are presented in an accurate and professional format. This document is essential because it helps lenders assess your creditworthiness and ability to repay the loan. By presenting a well-organized and precise paystub for mortgage, you not only expedite the approval process but also build trust with financial institutions, making it a critical tool for anyone looking to secure a mortgage in today’s competitive market.

Our online generator simplifies the process of creating a paystub for mortgage by allowing you to input your income details into a secure, user-friendly platform. Once the information is entered, our system processes the data and automatically formats it into a professional document that meets industry standards. The entire process is streamlined and efficient, reducing the time and effort typically associated with manual document creation. This digital approach not only minimizes the risk of errors but also provides you with a ready-to-use paystub for mortgage in just a few clicks, ensuring that you have the documentation needed to move forward with your mortgage application swiftly.

Absolutely. We take data security very seriously. Our paystub for mortgage generator employs advanced encryption and secure data storage protocols to ensure that your sensitive information is fully protected throughout the entire process. From the moment you enter your details to the final generation of your document, every step is designed with stringent security measures to prevent unauthorized access. This commitment to security means that you can confidently use our tool without worrying about data breaches or privacy issues, making it a reliable choice for your mortgage documentation needs.

Yes, our tool offers a high degree of customization to ensure that your paystub for mortgage accurately reflects your financial situation. You can tailor various aspects of the document, such as adding or modifying specific income details, adjusting deductions, and selecting different template designs. This flexibility allows you to generate a paystub that not only meets the standard requirements of lenders but also aligns with your unique financial profile. By providing a customizable solution, we help you present a document that is both professional and personalized, ensuring that it works perfectly for your mortgage application.

Time is of the essence in the mortgage application process, and our generator is designed to provide you with a paystub for mortgage almost instantly. Once you enter your financial details, the system processes the information in real-time and produces a professionally formatted document within seconds. This rapid turnaround ensures that you can keep pace with the fast-moving mortgage market and submit your application without unnecessary delays. The quick generation process also means that you have more time to focus on other aspects of your home-buying journey, making the overall experience both efficient and stress-free.

If you experience any difficulties while generating your paystub for mortgage, our dedicated customer support team is available to help. Whether you run into technical issues, have questions about the input process, or need assistance with customization options, our experts are ready to provide prompt and effective solutions. We understand that even the best tools can sometimes encounter challenges, and we are committed to ensuring that your experience remains smooth and hassle-free. Our support team is reachable through multiple channels, ensuring that help is always just a click or a call away, so you can resolve any issues quickly and continue with your mortgage application process.

While our primary focus is on delivering a professional paystub for mortgage, the versatility of our platform extends to other financial documentation needs as well. Many users find that the same streamlined process can be adapted for creating various income verification documents, making it a valuable tool for multiple purposes. However, if you have specific requirements beyond generating a paystub for mortgage, we recommend exploring the additional features and services available on our platform. The flexibility of our tool allows you to address a wide range of financial documentation challenges, making it a robust solution for your diverse needs.

We pride ourselves on transparency and straightforward pricing. When you use our paystub for mortgage generator, you can rest assured that there are no hidden fees or surprise charges. The cost associated with generating your document is clearly outlined from the start, ensuring that you know exactly what you are paying for. This level of transparency is crucial in building trust and ensuring a positive user experience. Our commitment to fair pricing means that you receive high-quality, professional documentation without any unexpected expenses, allowing you to proceed with your mortgage application with confidence and clarity.

A well-prepared paystub for mortgage serves as a vital tool in streamlining your mortgage application. By providing lenders with a detailed and accurate snapshot of your financial health, it facilitates a smoother and more efficient review process. The clarity and precision of a professionally generated paystub for mortgage help reduce the likelihood of delays and additional verification requests, thereby expediting the overall approval process. Moreover, a clear and concise document can instill confidence in lenders, demonstrating that you have taken the necessary steps to ensure transparency and accuracy in your financial reporting. This can significantly boost your credibility and enhance your chances of securing favorable mortgage terms.

Yes, our paystub for mortgage generator is designed with flexibility in mind. Should your financial situation change, you can easily update your details and regenerate your paystub for mortgage with minimal effort. The process is simple and intuitive, allowing you to modify existing information without having to start from scratch. This ease of updating ensures that your financial documentation remains current and reflective of your true income, which is crucial for maintaining the accuracy required by lenders. Whether it’s a change in salary, deductions, or any other financial component, our tool makes it effortless to keep your paystub for mortgage up-to-date, ensuring that you are always prepared for any changes in your mortgage application process.