🚀 Paystub Generator California

Your Ultimate Paystub Generator in California: Fast, Accurate, and Fully Compliant

Say Goodbye to Manual Calculations with Our California Paystub Generator

- Apartment Leasing Process

- Mortgage Qualification

- Small Business Loan Request

- Income Verification for Dependents Support

- Health Insurance Application Process

- Empower Employee Finance

- Uphold Employment Laws

- Transparent Pay

- Auto Pay Stub Calculation

- Payroll Document Management

PaystubHero has solutions to All Your document needs

What Exactly is a Paystub and Why is it Crucial in California?

A paystub is more than just a piece of paper; it’s a comprehensive financial record that outlines an employee’s earnings, deductions, and net pay. In California, providing a paystub isn’t optional—it’s a legal necessity. Employers are mandated by California labor laws to furnish an itemized statement that includes specific details such as gross wages, all forms of deductions, and net pay. This ensures a transparent financial relationship between employers and employees.

Failure to comply can result in severe penalties, including fines and legal action. Therefore, it’s not just about providing a paystub; it’s about providing a paystub that meets the stringent requirements of California law. This is where our service comes into play. We offer a California-specific paystub generator that takes the guesswork out of the equation, ensuring that you’re always in compliance with state laws.

The Inefficiencies of Manual Paystub Creation

Creating paystubs manually is not just tedious but also fraught with risks. The manual process involves numerous calculations, which are not only time-consuming but also susceptible to human error. A single mistake can lead to incorrect tax calculations, which can subsequently result in hefty fines and penalties from tax authorities.

Moreover, California has specific laws and regulations concerning paystubs, making the manual process even more complicated. Employers often find themselves spending excessive amounts of time ensuring compliance, time that could be better spent on core business activities. This is why an automated, California-specific paystub generator is not just a convenience but a necessity.

Avoid the Pitfalls of Generic Online Paystub Generators in California

The internet is flooded with online paystub generators, but not all are created equal. Many of these platforms do not cater to state-specific requirements, particularly those of California. Using a generic paystub generator can put you at significant risk for non-compliance with state laws, leading to potential legal issues and financial penalties.

Our platform is different. We understand the intricacies of California paystub laws and have designed our generator to be fully compliant, ensuring that you never have to worry about legal repercussions.

California Paystub Laws: What You Need to Know Before Generating a Paystub

In California, generating a paystub isn’t just a matter of convenience—it’s a legal requirement. Here are some key laws you should be aware of

Itemized Statement

California Labor Code Section 226(a) mandates that employers provide an itemized statement with each payment of wages. This statement must include gross wages earned, total hours worked, all deductions, and net wages earned.

Electronic Paystubs

While electronic paystubs are allowed, they must be easily accessible and printable. Employers must also provide a way for employees to securely access their electronic paystubs.

Record-Keeping

Employers are required to keep accurate payroll records for at least three years. Failure to do so can result in penalties.

Penalties for Non-Compliance

Employers who fail to provide accurate and itemized paystubs can face penalties ranging from $50 for the first offense to $100 for each subsequent offense, up to a maximum of $4,000.

Employee Rights

Employees have the right to request copies of their paystubs and can even file a claim against their employer if they fail to provide them.

Understanding these laws is crucial for maintaining compliance and avoiding legal complications. Our paystub generator is designed to meet all these legal requirements, ensuring that you’re always in compliance with California law.

*10% discount going on for the first time. Use coupon code: WELCOME10

Unmatched Features of Our California Paystub Generator

Our paystub generator is not just another online tool; it’s a comprehensive solution designed with the California employer and employee in mind. Here’s why you should choose us

Experience the Advantages

of a State-Specific Paystub Generator

Experience the Advantages of a State-Specific Paystub Generator

Streamlined Process

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

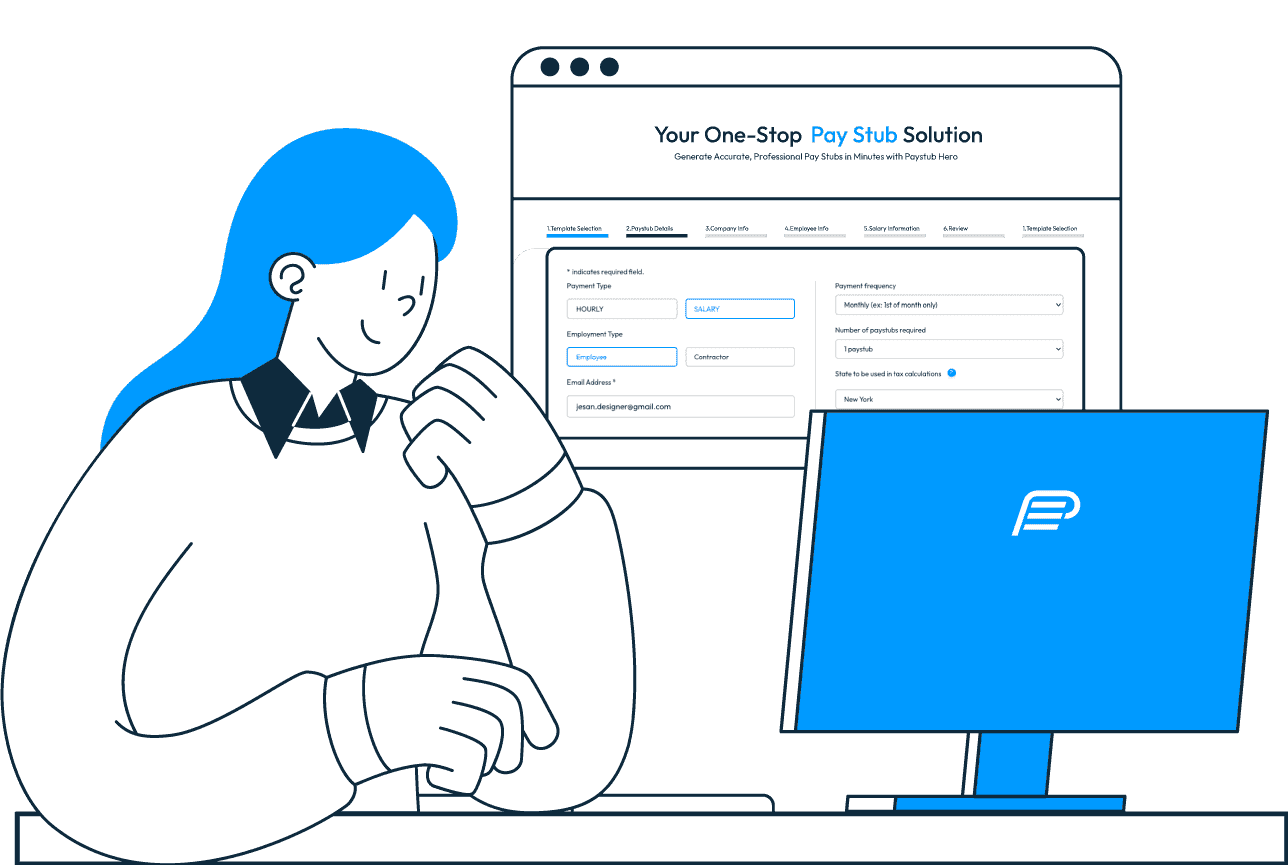

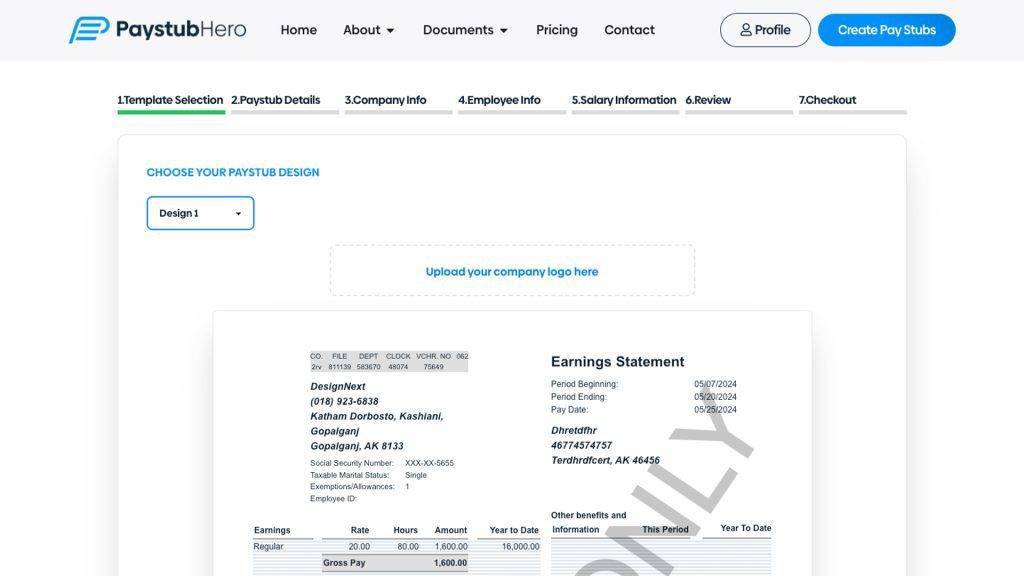

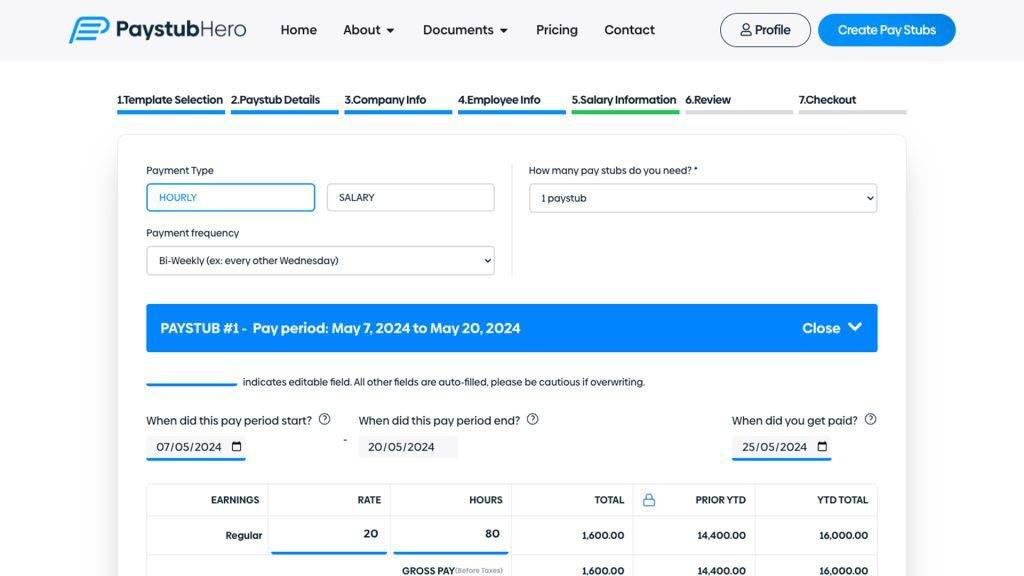

How to use our Paystub Generator?

Choose a pay stub template from our 6 designs

Enter Information such as company name, your work schedule and salary details

Download your paycheck stubs directly from your email in PDF format

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just Only $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Invoice

$11.99

/ Per Invoice

Unbeatable Value at Just Only $11.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Offer Letter

$12.99

/ Per Offer Letter

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

We've Helped 839,492 Customers Create Their Paystub Template Using Our Stub Generator

Get your questions answered

Absolutely. Our platform is designed to be fully compliant with all California state laws regarding paystubs. We ensure that all the required information is included in the paystub, keeping you safe from any legal issues.

Our system is designed for efficiency. You can generate a California-compliant paystub in just a few minutes.

Security is one of our top priorities. We use advanced encryption technologies to ensure that your data is completely secure.

Yes, we offer 24/7 customer support to assist you with any questions or issues you may have.

Absolutely. We offer competitive pricing options, and you can even avail of discounts for bulk orders.

Yes, our platform supports bulk paystub generation, making it easier for employers to manage multiple employees.

We frequently run promotions and offer discounts, especially for bulk orders. Keep an eye on our website for the latest offers.

You'll need basic information like employee name, employer name, salary details, and work period. Our platform guides you through the process step-by-step.

Our algorithms are updated regularly to align with federal and California state tax laws, ensuring accurate calculations every time.

No, there are no hidden fees. The price you see is the price you pay.