🚀 Best Paystub Generator for Self Employed

The Ultimate Paystub Generator for Self Employed Professionals

Accurate, Fast, and Reliable Paystubs Tailored for Independent Workers

- Apartment Leasing Process

- Mortgage Qualification

- Small Business Loan Request

- Income Verification for Dependents Support

- Health Insurance Application Process

- Empower Employee Finance

- Uphold Employment Laws

- Transparent Pay

- Auto Pay Stub Calculation

- Payroll Document Management

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

Understanding Paystubs

A paystub, often referred to as a paycheck stub or wage slip, is a comprehensive record that details an employee’s or contractor’s earnings for a specific period. It breaks down the gross income, various deductions, taxes, and the final net pay. For self-employed individuals, maintaining an accurate paystub is paramount. Not only does it serve as a testament to their earnings, but it’s also essential when applying for loans, mortgages, or when undergoing income verification processes. In the USA, there are specific laws and regulations governing the information that must be included in a paystub. This includes clear delineation of gross wages, federal and state taxes, insurance deductions, retirement contributions, and any other relevant deductions, leading to the net pay. With the rise of gig economy jobs and freelance work, the need for a reliable and compliant paystub generator for the self-employed has never been more pressing. Our platform ensures that self-employed professionals can easily generate paystubs that adhere to all legal requirements while accurately reflecting their income and deductions.

The Challenge of Paystub Generation for Self-Employed

The self-employed face unique challenges in generating accurate paystubs. Traditional systems cater to salaried employees, often overlooking the variable income patterns of freelancers and contractors. This oversight can lead to inaccuracies and hinder financial processes like loan applications. The need for a tailored paystub solution for the self-employed is evident, emphasizing the importance of a dedicated and reliable paystub generator.

Why Traditional Paystubs Fall Short for the Self-Employed

- Traditional paystubs often miss the mark for the self-employed. They’re designed for regular salaries, not accounting for the fluctuating incomes of freelancers or gig workers. This mismatch can result in discrepancies, posing challenges in financial verifications. The self-employed require a solution that understands their unique income dynamics, ensuring accuracy and compliance in every paystub generated.

Features of Our Tailored Paystub Generator

Our paystub generator isn’t just another tool; it’s a comprehensive solution designed specifically with the self-employed in mind. Recognizing the unique challenges faced by freelancers, contractors, and other independent professionals, we’ve integrated features that address these specific needs. From capturing diverse income streams to accounting for varied deductions, our platform ensures that every detail is meticulously recorded. The user-friendly interface ensures a seamless experience, while the robust backend guarantees accuracy and compliance with all relevant regulations.

100% Accuracy

Every paystub generated is a testament to precision. Our algorithms are fine-tuned to ensure that every entry, deduction, and calculation is spot-on, giving you peace of mind.

Instant Generation

Time is money, especially for the self-employed. Our platform delivers your paystub in minutes, ensuring you can move on to other important tasks without delay.

Compliance Assured

Stay on the right side of the law. Our paystub generator is updated with the latest regulations, ensuring that your document is always compliant with state and federal requirements.

Exceptional Support

Questions? Concerns? Our dedicated support team is always on standby, ready to assist and guide you through any challenges you might encounter.

Benefits of Using Our Paystub Generator for Self-Employed Professionals

Unlock the Advantages of a Tailored Paystub Solution for Self-Employed Needs

Experience the Advantages

of a State-Specific Paystub Generator

Experience the Advantages of a State-Specific Paystub Generator

Streamlined Process

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

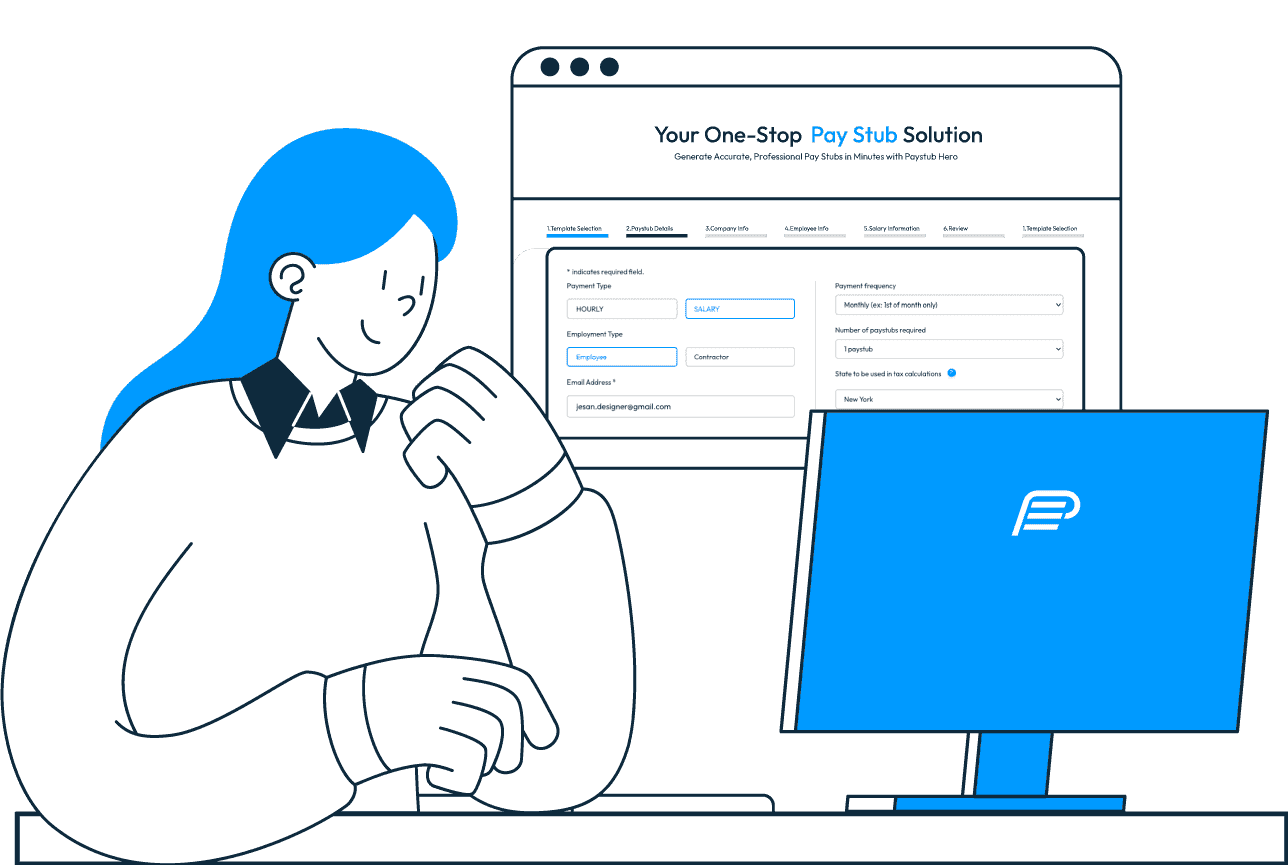

Create Your

Paystub in Minutes

Follow our simple step-by-step process

1. Enter Your Information

Start by entering the necessary details directly on our homepage. This includes your employer's details, your personal information, income details, and any additional information required.

2. Review Your Information

Once you've input all your details, take a moment to review everything for accuracy. Make sure all information is correct to avoid any issues with your pay stub.

3. Generate Your Paystub

Click on the 'Generate Paystub' button. Our advanced system will create a professional, compliant paystub based on the details you've provided.

4. Download and Print

Finally, download your paystub instantly! You can print it immediately or save it for future use. It's as simple as that. No sign-up, no fuss!

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

- A paystub generator for self-employed professionals is a specialized tool designed to create accurate and compliant paystubs for those who don't receive regular salaries from employers. Unlike traditional employees, self-employed individuals have varied income streams, which can include hourly rates, project-based payments, or irregular earnings. This tool captures all these nuances, ensuring that the generated paystub reflects the true nature of a self-employed person's earnings, complete with all necessary deductions and taxes.

Even if you're self-employed, there are numerous scenarios where you might need to provide proof of income. This could be for loan applications, rental agreements, or even certain service subscriptions. A paystub serves as a credible document that showcases your earnings, deductions, and net income, providing third parties with a clear snapshot of your financial health.

Our paystub generator for self-employed individuals is tailored to cater to the unique financial dynamics of freelancers, contractors, and gig workers. It accounts for varied income sources, fluctuating earnings, and specific deductions that might not be present in traditional paystubs. The goal is to provide a comprehensive and accurate representation of a self-employed person's earnings.

Absolutely! Our paystub generator is updated regularly to ensure it adheres to both federal and state-specific regulations. Whether it's tax rates, specific deductions, or other legal requirements, our tool ensures that your paystub is compliant and can stand up to scrutiny.

Our platform is designed for efficiency. Once you input all the necessary details, the paystub is generated in mere minutes. This quick turnaround ensures you have the documentation you need, right when you need it.

Absolutely. We prioritize the security and confidentiality of your financial data. Our platform employs state-of-the-art encryption and security protocols to ensure that your information remains protected and is never shared with unauthorized parties.

Yes, our paystub generator for self-employed professionals offers a degree of customization. You can input specific details, choose from various templates, and ensure that the final document aligns with your preferences and requirements.

- Our tool is designed to handle the complexities of self-employed earnings. If you have multiple income streams, you can input each one separately, ensuring that the final paystub provides a holistic view of your earnings.

No, our paystub generator is web-based and accessible through any standard web browser. There's no need for any downloads or installations. Simply visit our website, input your details, and generate your paystub.

We pride ourselves on our exceptional customer support. If you encounter any challenges or have questions, our dedicated support team is always ready to assist. You can reach out via email, chat, or phone, and we'll ensure that your concerns are addressed promptly.