🚀 Proof of Income Letter Self-Employed

Your Ultimate Guide to Proof of Income Letter for Self-Employed Individuals

Empower Your Financial Verification with a Proof of Income Letter Self-Employed

- Apartment Leasing Process

- Mortgage Qualification

- Small Business Loan Request

- Income Verification for Dependents Support

- Health Insurance Application Process

- Use for Income Verification

- Remove need for paystubs

- Say goodbye to rental hassles

- Secure your Dream Apartment

- Say “NO” to income verification hurdles

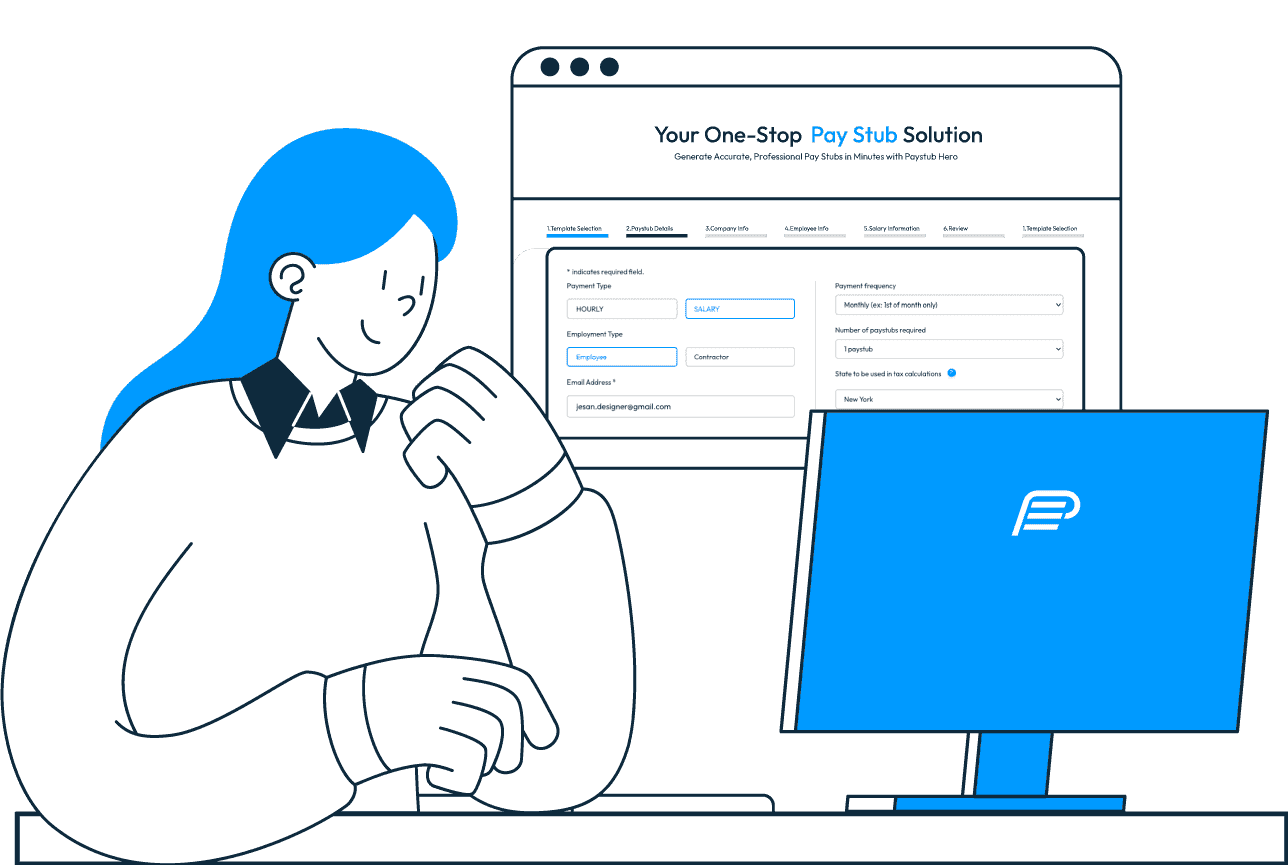

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

Invoice

Effortlessly Create Your Invoice and Make Your Business Feel Professional

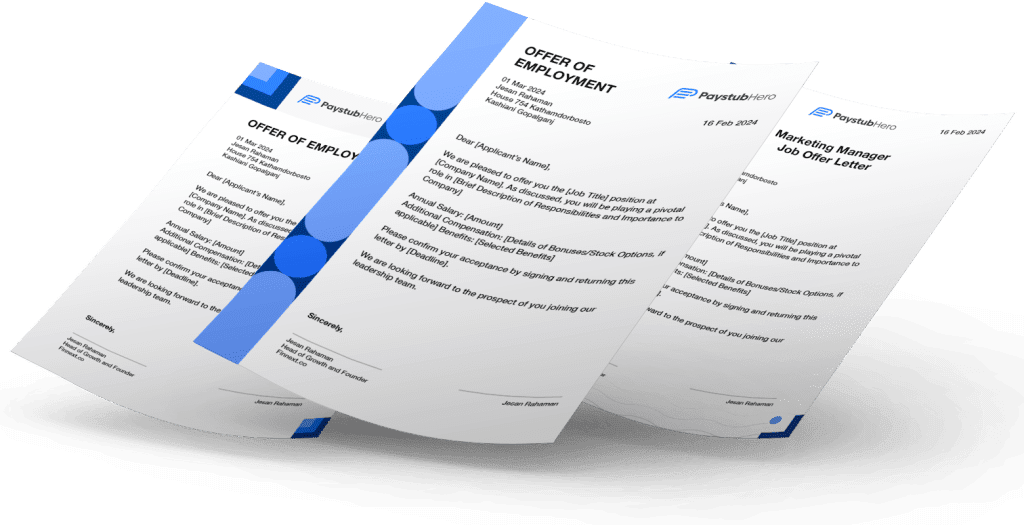

Offer Letter

Secure your Dream Apartment with an Offer letter!

Understanding Proof of Income Letter for Self-Employed

A Proof of Income Letter for Self-Employed individuals serves as a vital document that officially verifies personal income when traditional employment records are not available. This letter is essential for self-employed professionals, freelancers, and entrepreneurs who need to prove their financial standing to lenders, landlords, or governmental bodies. Unlike salaried individuals who can easily present payslips or W-2 forms, self-employed persons must provide a detailed account of their income sources, often requiring more substantial evidence to substantiate their earnings.

Creating a reliable Proof of Income Letter involves compiling income streams, expenses, and net income, often with the inclusion of tax returns, bank statements, and client invoices to lend credibility. This document not only facilitates financial transactions like securing loans, leasing property, or applying for credit but also plays a crucial role in legal and tax-related matters. For self-employed individuals in the USA, adhering to IRS guidelines is paramount, making the accuracy and legitimacy of a Proof of Income Letter critical. It not only demonstrates fiscal responsibility but also ensures compliance with federal and state tax laws, providing a structured framework for income verification that aligns with legal standards.

Challenges in Proving Income for Self-Employed

Navigating the financial landscape as a self-employed individual comes with its unique set of challenges, particularly when it comes to proving income. Traditional income verification documents like W-2 forms and paystubs, which are readily available to salaried employees, do not exist for those who work for themselves. This discrepancy creates a significant barrier in accessing financial services such as mortgages, personal loans, and rental agreements, where proof of stable income is a prerequisite. Financial institutions and landlords often view self-employed individuals as high-risk due to the perceived volatility of their income, demanding more rigorous proof of earnings. This heightened scrutiny can delay or derail the financial aspirations of self-employed professionals, underscoring the need for a streamlined, universally accepted method of income verification that bridges the gap between self-employed individuals and the financial services they seek to access.

Streamlined Income Verification with Proof of Income Letter Self-Employed

The solution to the income verification challenge for self-employed individuals lies in an innovative, online Proof of Income Letter generator. This digital tool is specifically designed to address the unique needs of freelancers, contractors, and entrepreneurs by providing a streamlined, efficient way to produce verifiable income documents. By leveraging technology, the service simplifies the process of generating a Proof of Income Letter, allowing users to input their financial details into a user-friendly platform that automatically calculates and presents their income in a professionally formatted document.

This solution not only mitigates the risk perceived by lenders and landlords but also empowers self-employed individuals with the ability to quickly respond to financial opportunities without the typical bureaucratic delays. The digital nature of the service ensures that users can access it from anywhere, at any time, making it exceptionally convenient for those with busy, non-traditional work schedules. Additionally, it offers the flexibility to customize the document to meet various requirements, whether for a loan application, housing lease, or other financial verifications, thereby significantly enhancing the financial inclusivity of self-employed individuals in the market.

Key Features of Our Proof of Income Letter Generator for Self-Employed

Our Proof of Income Letter Generator for Self-Employed individuals is engineered to alleviate the traditional challenges faced by freelancers, entrepreneurs, and independent contractors in proving their income. This robust platform integrates cutting-edge technology with user-centric design to offer a seamless, efficient experience. Users can easily input their financial details, from which the system generates a detailed, accurate Proof of Income Letter. The customization features allow for modifications to the document, ensuring it meets the specific requirements of different entities, be it for loan applications, housing agreements, or other financial verification purposes.

Moreover, our platform addresses the paramount concern of privacy and security, implementing state-of-the-art encryption to safeguard user data. Accessibility is another cornerstone of our service, with the platform being available around the clock, catering to the non-traditional working hours of self-employed individuals. This 24/7 accessibility ensures that users can manage their financial verification needs on their terms and timelines, offering unparalleled convenience.

Tailored Customization for Varied Needs

Our platform stands out by offering extensive customization options, enabling users to tailor their Proof of Income Letters to meet the nuanced demands of various financial and rental institutions. This level of personalization ensures that the documents not only meet but exceed the specific criteria required for loans, leases, and more, significantly boosting the likelihood of approval. The ability to adjust and fine-tune every aspect of the letter, from income details to the presentation format, underscores our commitment to providing a truly versatile and user-oriented solution.

Unquestionable Credibility with Professional Formatting

The essence of our Proof of Income Letter Generator lies in its ability to produce documents that are not just accurate but also exhibit a high degree of professionalism. This professional presentation enhances the user's credibility, making a positive impression on lenders, landlords, and any entity requiring proof of income. The sophisticated design and layout of our letters reflect a level of seriousness and reliability, crucial in financial dealings, thereby facilitating smoother transactions and interactions.

Swift and Stress-Free Document Creation

In today's fast-paced world, time is of the essence. Our platform is designed for efficiency, allowing users to generate their Proof of Income Letters in mere minutes. This rapid document creation process is a testament to the platform's intuitive design and streamlined workflow, which simplifies data entry and automates calculations. Users benefit from a hassle-free experience that not only saves time but also minimizes the stress associated with financial verifications, empowering them to meet their objectives quicker and with greater ease.

Universal Access, Anytime, Anywhere

Recognizing the diverse and dynamic nature of self-employment, our service is built for universal accessibility. The online platform's around-the-clock availability ensures that self-employed individuals can generate their Proof of Income Letters whenever necessary, without being constrained by traditional business hours. This flexibility is crucial for meeting tight deadlines and seizing opportunities as they arise, offering users the freedom to manage their financial verification needs from any location, at any time, thus embodying the ultimate in convenience and reliability.

Through these enhanced features and benefits, our Proof of Income Letter Generator is poised to revolutionize how self-employed individuals meet their financial verification needs, providing a reliable, efficient, and user-friendly solution.

Maximize Your Financial Opportunities with the Proof of Income Letter Self-Employed Service

Unlock the Advantages: How Our Proof of Income Letter Self-Employed Service Can Elevate Your Financial Standing

Enhance Your Financial Verification with Our Proof of Income Letter Self-Employed Solution

Explore the Benefits: Leveraging the Proof of Income Letter Self-Employed Service for Seamless Financial Transactions

Streamlined Process

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Your Offer Letter, Four Steps Away

Easily create a convincing offer letter for landlords and property managers.

1. Select Your Design

Begin by choosing a template that best fits your needs from our curated selection. Whether you're looking for something sleek and modern or more traditional, our designs ensure your offer letter stands out. Customize the layout to match your personal or professional aesthetic, ensuring a positive first impression.

2. Enter Company & New Hire Info

Input all relevant details about your company and the new position to personalize your offer letter. This includes company name, address, the position being offered, and salary details. Our platform guides you through each step, ensuring no critical information is missed, making your letter both comprehensive and compliant with standard practices.

3. Review & Customize

Preview your draft offer letter to ensure accuracy and completeness. At this stage, you can make any adjustments needed, from correcting typos to fine-tuning the job description and compensation package. This step ensures your offer letter accurately reflects the terms of employment, showcasing professionalism and attention to detail.

4. Download & Use

Once you're satisfied with the offer letter, proceed to checkout. After payment, your customized offer letter is ready for download. It comes in a format that's easy to share, whether you're sending it directly to the future employee or using it as proof of income for applications. Immediate access to your document means you can move forward without delay.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just Only $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Invoice

$7.50

/ Per Invoice

Unbeatable Value at Just Only $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Offer Letter

$8.50

/ Per Offer Letter

Unbeatable Value at Just Only $8.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

A Proof of Income Letter for Self-Employed individuals is a document that verifies your income when you do not have a traditional employer-employee relationship. This letter outlines your earnings from self-employment over a specified period, serving as evidence of your financial stability. It's particularly useful for applying for loans, securing leases, or any situation where proof of earnings is required. The letter typically includes your name, the nature of your self-employment, income received, and, if applicable, any business expenses.

For Self-Employed individuals, demonstrating a stable income can be challenging due to the fluctuating nature of self-employment. A Proof of Income Letter serves as a formal document that consolidates your earnings information in a way that's recognizable to lenders, landlords, and other entities requiring proof of income. This letter enhances your credibility and can significantly ease financial transactions, such as securing loans or renting property, by providing a clear, concise summary of your income.

Our online Proof of Income Letter generator is designed specifically for Self-Employed individuals. By entering your financial details, such as income sources, amounts, and any relevant expenses, our platform can quickly create a professional and accurate Proof of Income Letter. This process eliminates the need for manual calculations and formatting, providing you with a credible document that meets the requirements of financial institutions and landlords.

To generate a Proof of Income Letter, you'll need to provide details about your self-employment income, including the nature of your work, the period for which you're reporting income, total income received, and any applicable business expenses that might be relevant. It's important to have accurate financial records at hand, such as bank statements, invoices, and receipts, to ensure the information you input is precise and verifiable.

Our Proof of Income Letter has been carefully designed to meet the general requirements of most financial institutions and landlords. However, it's always a good idea to check with the specific entity to ensure they don't have additional requirements. Our letters are professional and comprehensive, making them widely accepted across various sectors for financial verification purposes.

While our Proof of Income Letter provides a detailed account of your earnings, which can be helpful for your tax records, it's essential to consult with a tax professional regarding its use for tax purposes. Tax authorities may have specific documentation requirements, and a tax professional can advise you on how best to use the Proof of Income Letter in conjunction with other necessary documents for tax filings.

Our service is designed for efficiency, allowing you to generate a Proof of Income Letter in just a few minutes. Once you've input all the required information and reviewed it for accuracy, the platform will immediately produce your document, ready for download and use. This quick turnaround is especially beneficial for meeting tight deadlines or urgent requests for income verification.

Absolutely. We prioritize the privacy and security of our users' information. Our platform uses advanced encryption and security measures to ensure that your personal and financial data is protected at all times. You can use our service with confidence, knowing that your information is secure and will not be shared without your consent.

Yes, our Proof of Income Letter generator offers customization options to suit various verification needs. Whether you're applying for a mortgage, a personal loan, or looking to lease a new apartment, you can tailor the letter to highlight the specific income information relevant to your application. This flexibility ensures that you can meet the unique requirements of different entities efficiently.

Our customer support team is here to help with any issues or questions you may have while using our service. You can reach out to us through our website's contact form, email, or phone support. We're committed to providing prompt and helpful assistance to ensure you have a smooth experience generating your Proof of Income Letter.