🚀 Self Employed 1099 Form

Effortlessly Create Your Self Employed 1099 Form with PayStubHero

Your Ultimate Guide to Self Employed 1099 Form: Simplify Tax Reporting with PayStubHero

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

Decoding the Self Employed 1099 Form for Clarity and Compliance

The 1099 form is an indispensable document for self-employed individuals in the USA, acting as a testament to their income earned from various non-salaried sources. This form is not just a piece of paper; it’s a vital component of the tax filing process, ensuring that self-employed professionals accurately declare their earnings to the Internal Revenue Service (IRS).

Primarily, the 1099 form is used to report income that doesn’t come from a traditional employer-employee relationship. This includes earnings from freelance work, independent contracting, and other forms of self-employment. The significance of this form lies in its role in maintaining transparency with the IRS, thereby avoiding potential legal complications that can arise from underreporting income.

For self-employed individuals, this form is more than just a tax requirement; it’s a reflection of their entrepreneurial journey. It encompasses various types of income, from payments for services rendered to earnings from rental properties, and even extends to certain types of debt cancellations. The diversity of income streams reported underlines the versatility and dynamism of the self-employed sector.

However, navigating the complexities of the 1099 form can be daunting. There are different versions of the form, like the 1099-NEC and 1099-MISC, each catering to specific types of income. Understanding which form to use, how to fill it out correctly, and meeting the filing deadlines are crucial steps in ensuring compliance and avoiding penalties.

In essence, the self employed 1099 form is a critical tool for financial management and legal compliance for those embracing the flexibility and challenges of self-employment. It’s a symbol of independence in the workforce, but also a reminder of the responsibility that comes with it. Accurate and timely filing of this form is not just fulfilling a legal obligation; it’s an integral part of the financial health and credibility of a self-employed professional.

Navigating the Tax Maze: The Self-Employed Challenge

For self-employed individuals, managing tax documentation, particularly the 1099 form, presents a significant hurdle. The process is often mired in complexity and confusion, leading to potential errors and legal issues. Many self-employed professionals struggle with accurately tracking and reporting income from diverse sources, a task that can be overwhelming without specialized knowledge or tools. This challenge is exacerbated by the ever-changing tax laws, making compliance a moving target. Consequently, the need for an efficient, user-friendly solution to streamline this process is more pressing than ever, especially for those who juggle multiple roles in their professional lives.

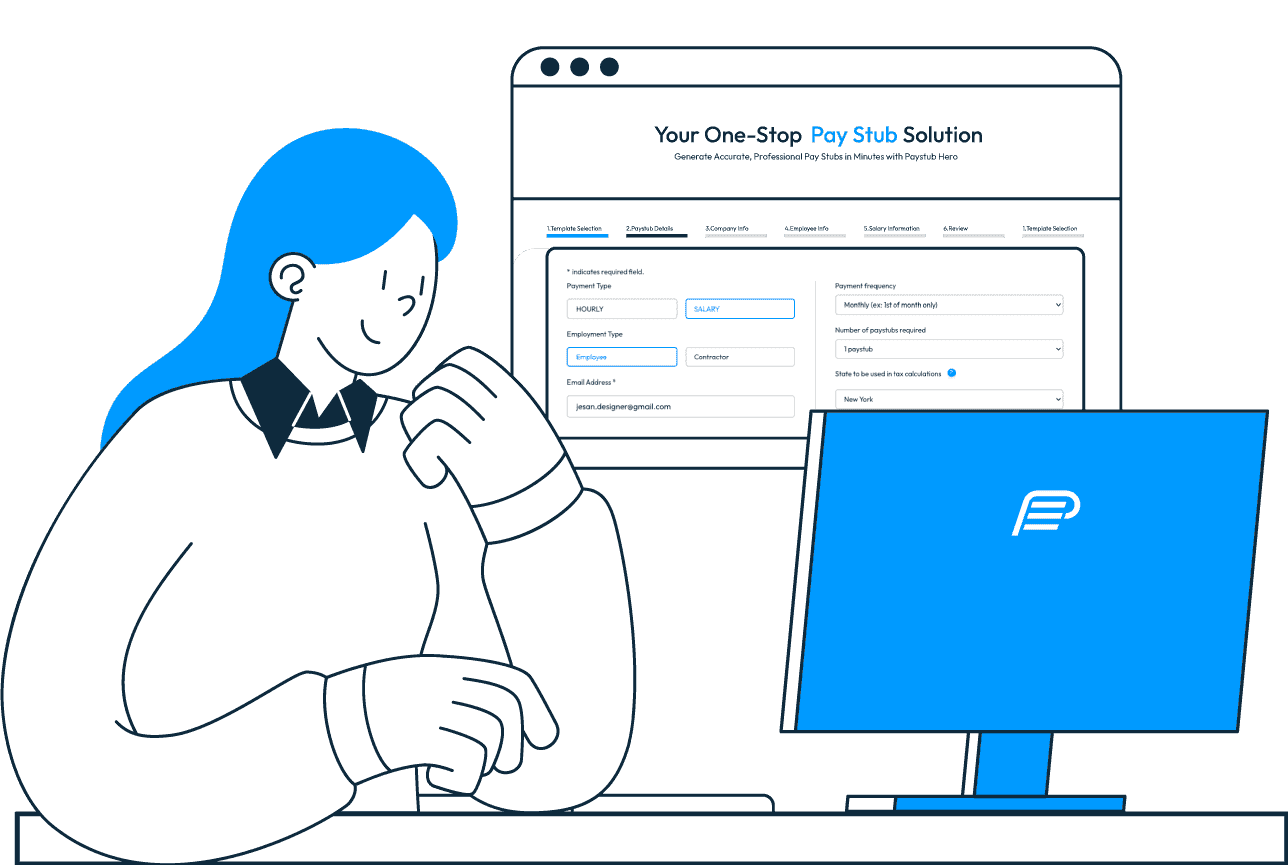

Streamlining Tax Reporting for the Self-Employed with PayStubHero

Addressing the complexities faced by self-employed individuals in tax documentation, PayStubHero offers a streamlined, efficient solution. Our platform simplifies the creation and management of 1099 forms, turning a traditionally cumbersome process into a straightforward, user-friendly experience. By providing easy access to customizable templates and clear guidance, we ensure that self-employed professionals can accurately report their income without the stress and confusion often associated with tax filing. This not only saves valuable time but also reduces the risk of errors and non-compliance. With PayStubHero, self-employed individuals gain the confidence to manage their tax obligations effectively, freeing them to focus more on growing their business and less on navigating the intricacies of tax regulations.

Enhancing Tax Documentation for the Self-Employed with PayStubHero

PayStubHero stands out as a comprehensive solution for self-employed professionals grappling with the complexities of tax documentation, especially the 1099 form. Our platform is meticulously crafted to address the unique challenges faced by those in the self-employed sector, offering a suite of features that transform tax reporting from a daunting task into a streamlined, manageable process.

Effortless Documentation

At the heart of PayStubHero is the promise of simplicity and efficiency. Our platform automates the creation of 1099 forms, eliminating the tediousness and potential errors associated with manual entry. This automation is a significant time-saver, allowing self-employed individuals to focus more on their business operations and less on administrative tasks.

Customizable Templates

Recognizing the diverse nature of self-employment, PayStubHero offers customizable templates to cater to various income types and business models. This flexibility ensures that each 1099 form accurately reflects the unique financial circumstances of the user, providing a personalized experience that generic forms cannot match.

User-Friendly Interface

Ease of use is a cornerstone of the PayStubHero experience. The platform is designed to be intuitive, ensuring that even those with minimal technical expertise can navigate and utilize its features effectively. This user-centric design philosophy ensures that all self-employed professionals, regardless of their tech proficiency, can manage their tax documentation with confidence.

Secure and Reliable

In an era where data security is paramount, PayStubHero places a high priority on protecting user information. Our platform employs advanced security protocols to safeguard sensitive financial data, ensuring that users' privacy and confidentiality are maintained at all times. This commitment to security provides peace of mind, knowing that your financial information is in safe hands.

Real-Time Updates and Support

Staying current with tax laws and regulations is crucial for compliance. PayStubHero is constantly updated to reflect the latest tax legislation, ensuring that the forms generated are always compliant. Additionally, our platform is backed by a dedicated support team, ready to assist users with any questions or issues, providing a reliable resource for guidance and troubleshooting.

Cloud-Based Accessibility

Flexibility and accessibility are key advantages of PayStubHero. Being a cloud-based platform, it allows users to access their tax documents from anywhere, at any time. This on-the-go accessibility is particularly beneficial for self-employed individuals who often work remotely or travel for business, ensuring that tax reporting doesn't have to be confined to a single location.

In summary, PayStubHero’s feature set is thoughtfully designed to alleviate the burdens of tax documentation for the self-employed. By offering a blend of automation, customization, ease of use, security, and accessibility, our platform not only simplifies the 1099 form process but also enhances the overall tax reporting experience. This comprehensive approach to feature development ensures that self-employed professionals have all the tools they need to manage their tax obligations efficiently and effectively, freeing them to dedicate more time and energy to growing their businesses and achieving their professional goals. With PayStubHero, the complexities of tax documentation become manageable, allowing self-employed individuals to navigate their financial responsibilities with confidence and ease.

Maximizing Efficiency with Self Employed 1099 Form: The PayStubHero Advantage

Unlock the Full Potential of Your Self Employed 1099 Form Experience

Elevate Your Tax Reporting with Self Employed 1099 Form Benefits from PayStubHero

Experience the Transformative Advantages of Using Self Employed 1099 Form with PayStubHero

Streamlined Process

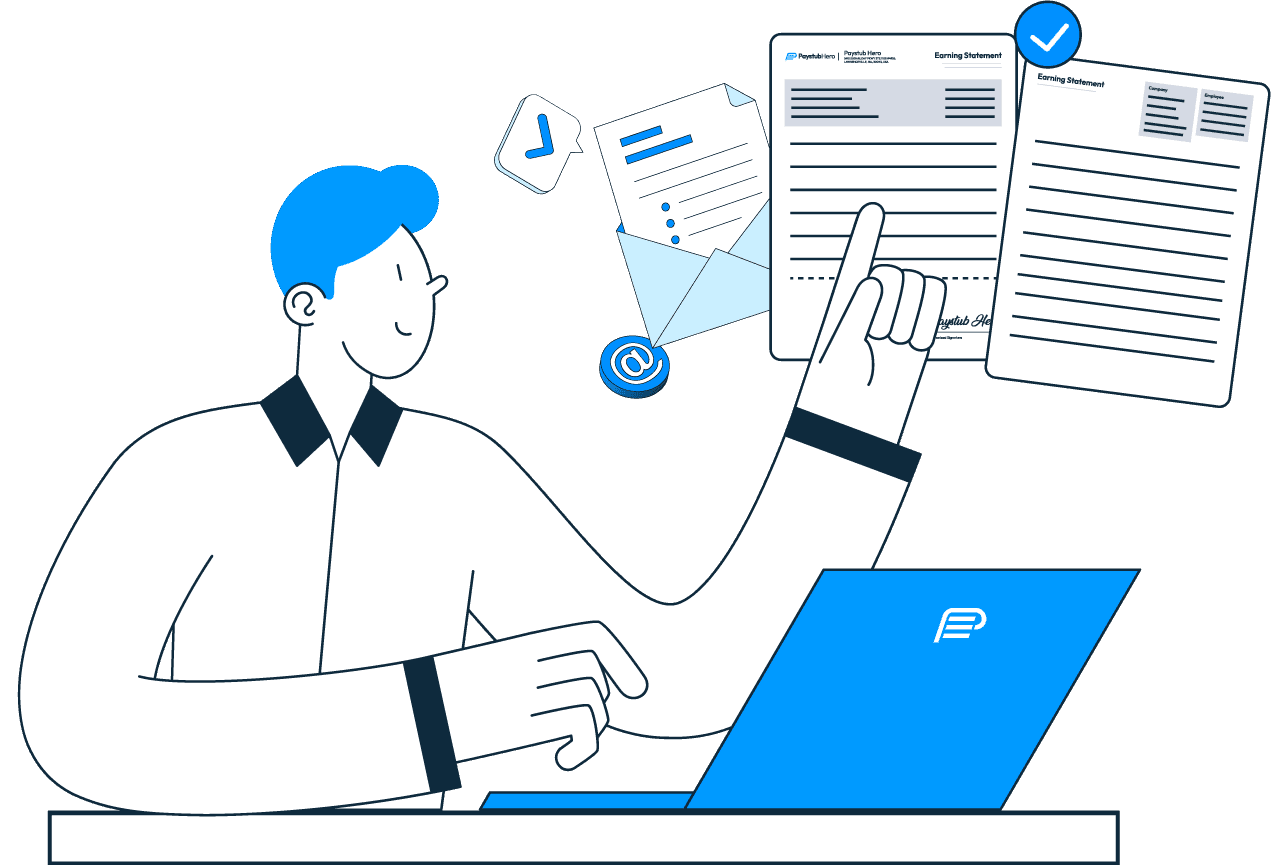

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Mastering the 1099 Form Texas Creation with Paystub Hero

A Step-by-Step Guide to Effortlessly Generate Your 1099 Form Texas

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate 1099

Instantly create a digital copy.

4. Download

Access your 1099 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

The Self Employed 1099 Form is a tax document used in the United States by self-employed individuals, freelancers, and independent contractors. It's a way to report income earned outside of traditional employment to the IRS. This form is crucial for accurately declaring earnings from various sources, ensuring compliance with tax laws and avoiding potential penalties.

Any individual who earns more than $600 in a year from self-employment activities, freelance work, or as an independent contractor should file a Self Employed 1099 Form. This is essential for reporting income that isn't subject to automatic withholding, and it's a key part of managing your tax obligations as a self-employed professional.

PayStubHero streamlines the 1099 form process by providing easy-to-use, customizable templates and a user-friendly platform. This simplifies the traditionally complex task of tax reporting, ensuring accuracy and compliance with IRS guidelines. Our platform also offers guidance and support, making it easier for self-employed individuals to manage their tax documentation.

Failing to file a Self Employed 1099 Form can result in significant penalties from the IRS. These can include fines for late filing and inaccuracies, as well as interest on unpaid taxes. The exact penalties depend on how late the form is filed and the amount of underreported income.

Yes, PayStubHero offers a comprehensive record-keeping feature that allows you to access and review your 1099 forms from previous years. This is invaluable for maintaining an organized financial history and can be especially helpful during audits or when planning for future tax obligations.

Absolutely. PayStubHero prioritizes the security of your financial data. We use advanced encryption and security protocols to ensure that your information is protected against unauthorized access and breaches. Your privacy and the confidentiality of your financial information are paramount to us.

PayStubHero's platform guides you in selecting the appropriate 1099 form based on your specific income types and sources. We stay updated with the latest IRS regulations to ensure that you're using the correct form for your self-employment income, whether it's from freelance work, independent contracting, or other sources.

PayStubHero stands out due to its user-friendly interface, customizable templates, real-time updates in line with IRS changes, and robust customer support. Our platform is specifically designed to cater to the needs of self-employed individuals, offering a more personalized and efficient experience than generic tax software.

Yes, in addition to generating 1099 forms, PayStubHero provides tools and resources to help with broader aspects of self-employment taxes. This includes income tracking, tax deduction identification, and integration with other financial management tools, making it a comprehensive solution for your tax-related needs.

For those new to self-employment tax reporting, PayStubHero offers extensive support including detailed guides, FAQs, and customer service assistance. Our platform is designed to be intuitive, but we also provide additional resources to help you understand the nuances of self-employment taxation and ensure you're confident in using our services.