🚀 W2 Form Template

Your Ultimate W2 Form Template Solution

Streamline Your Tax Filing with Our W2 Form Template

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

PaystubHero has solutions to All Your document needs

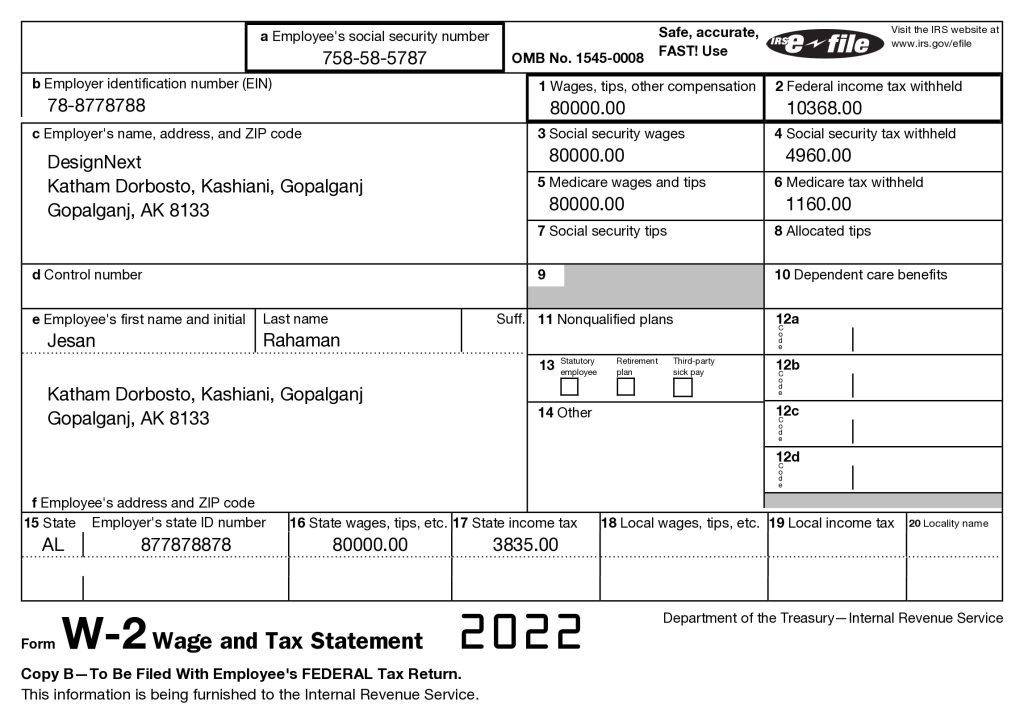

Understanding the W2 Form Template

The W2 form template is an essential document for both employers and employees in the United States, serving as a cornerstone in the annual tax filing process. This standardized form is used by employers to report an employee’s annual wages and the amount of taxes withheld from their paycheck to the Internal Revenue Service (IRS). The significance of the W2 form extends beyond mere tax reporting; it is a critical document that ensures compliance with federal tax laws, facilitating accurate tax return filings for employees.

Legally, employers are mandated to furnish employees with their W2 forms by January 31st following the end of the tax year, ensuring that individuals have sufficient time to file their taxes before the deadline, typically April 15th. The W2 form template includes various sections that detail the employee’s income, including wages, tips, and other compensations, alongside deductions such as federal income tax, Social Security tax, and Medicare tax withholdings.

The importance of the W2 form template cannot be overstated, as it directly impacts an individual’s tax liabilities and potential refunds. It also plays a pivotal role in verifying an employee’s income for loans, mortgages, and other financial considerations. Given its significance, the accuracy and timeliness of the W2 form are paramount. Errors or delays in issuing the W2 form can lead to penalties for employers and complications for employees in filing their tax returns.

In response to the complexities and legal requirements surrounding the W2 form, online document generators like PaystubHero.com have emerged as invaluable resources. These platforms offer customizable W2 form templates, simplifying the process for employers and ensuring compliance with all relevant tax laws. By leveraging such services, businesses can streamline their tax reporting processes, minimize errors, and uphold their legal obligations, all while providing a seamless experience for their employees.

Understanding the Market Problem with W2 Form Templates

In today’s fast-paced business environment, the process of generating accurate and compliant W2 forms remains a significant challenge for many employers and small business owners across the USA. The complexity of tax regulations, combined with the need for precision in reporting employee earnings and withholdings, often leads to errors and inefficiencies. This not only consumes valuable time and resources but also increases the risk of penalties from tax authorities for non-compliance. Moreover, the lack of accessible, user-friendly tools to streamline this process exacerbates the issue, leaving businesses struggling to manage their payroll obligations effectively. This market problem underscores the urgent need for a reliable, efficient solution that simplifies the creation of W2 forms, ensuring accuracy and compliance with ease.

Introducing the Ideal Market Solution for W2 Form Templates

In response to the pressing challenges faced by employers and small businesses in managing payroll tax reporting, our online document generator emerges as the perfect market solution. By offering an intuitive, easy-to-use W2 form template, we directly address the core issues of complexity, time consumption, and the risk of errors. Our platform simplifies the entire process of generating W2 forms, making it accessible to users regardless of their tax knowledge or technical expertise. With features designed to ensure accuracy and compliance, users can confidently produce their W2 forms, significantly reducing the likelihood of penalties for incorrect filings. Furthermore, our solution saves businesses invaluable time and resources, allowing them to focus on their core operations while trusting us to handle their payroll documentation needs efficiently. This innovative approach not only solves the existing market problem but also sets a new standard for payroll processing in the digital age.

Cutting-Edge Features of Our W2 Form Template Solution

Our online W2 form template solution is designed with a suite of cutting-edge features that cater to the specific needs of employers and small businesses, ensuring a seamless, efficient, and compliant tax reporting process. Here’s a detailed look at the core features and their benefits:

User-Friendly Interface

Our platform boasts a highly intuitive interface, making it easy for users to navigate and generate their W2 forms without requiring extensive tax knowledge or technical skills. This simplicity ensures that all users can efficiently complete their tax reporting, saving time and reducing the risk of errors.

Real-Time Error Checking

Leveraging advanced algorithms, our system performs real-time error checking to identify and alert users of any potential inaccuracies before submission. This proactive approach significantly reduces the likelihood of filing errors, ensuring compliance and peace of mind.

Customizable Templates

Understanding that no two businesses are the same, our W2 form templates are fully customizable. Users can adjust various fields to match their specific payroll data requirements, offering flexibility and precision in tax document preparation.

Secure Data Management

Security is paramount in our platform. We employ state-of-the-art encryption and data protection measures to safeguard user information, ensuring that all payroll data remains confidential and secure from unauthorized access.

Our W2 form template solution stands out in the market for its comprehensive approach to solving the common challenges faced by businesses during tax season. By integrating these advanced features into our platform, we offer a robust solution that not only simplifies the tax filing process but also enhances accuracy, efficiency, and security. The user-friendly interface ensures that generating W2 forms is a straightforward task, eliminating the steep learning curve often associated with tax software. Real-time error checking acts as a safeguard against common mistakes, providing users with additional confidence in their filings. The customizable nature of our templates allows for a personalized experience, ensuring that each business can accurately reflect its unique payroll circumstances. Finally, our unwavering commitment to data security means that sensitive information is always protected, giving users peace of mind. Together, these features create a powerful tool that addresses the needs of today’s businesses, making our W2 form template solution an indispensable asset for efficient and compliant tax reporting.

*10% discount going on for the first time. Use coupon code: WELCOME10

Key Benefits of Our W2 Form Template

Elevate Your Tax Filing Experience with Unmatched Efficiency

Discover the Advantages of Our W2 Form Template

Transform Your Tax Preparation with Our W2 Form Template Efficiency

Streamlined Process

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Step-by-Step Guide to Creating a W2 Form Image

Follow our simple step-by-step process

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate W2

Instantly create a digital copy.

4. Download

Access your W2 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just Only $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Invoice

$11.99

/ Per Invoice

Unbeatable Value at Just Only $11.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Offer Letter

$12.99

/ Per Offer Letter

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

We've Helped 839,492 Customers Create Their Paystub Template Using Our Stub Generator

Frequently Asked Questions

A W2 form template is a pre-designed document layout used to generate W2 forms, which report an employee's annual wages and the amount of taxes withheld from their paycheck. It simplifies the process of creating W2 forms by providing a standardized format, ensuring that all necessary information is accurately and efficiently reported. This is crucial for both employers and employees to ensure compliance with IRS regulations and to facilitate the accurate filing of tax returns.

Our W2 form template is designed with built-in checks and balances that automatically calculate the correct tax withholdings and ensure that all required fields are completed accurately. This minimizes errors and omissions, helping employers comply with IRS guidelines. Additionally, our templates are regularly updated to reflect the latest tax laws and regulations, ensuring that your filings are always compliant.

Absolutely. Our W2 form template is designed to be user-friendly, making it accessible to individuals with varying levels of tax preparation experience. With clear instructions and the ability to automatically calculate tax withholdings, our template simplifies the process, making it easy for anyone to complete their W2 forms accurately.

Our online W2 form template stands out due to its ease of use, accuracy, and compliance features. Unlike many other templates, ours is designed with the end-user in mind, offering a straightforward, guided process for filling out the form. Additionally, our template is always up-to-date with the latest tax regulations, ensuring that your filings meet all legal requirements.

Yes, we prioritize the security of your data. Our platform uses advanced encryption and security protocols to protect the information you input into the W2 form template. Your data is securely stored and transmitted, ensuring that your personal and financial information remains confidential.

Our W2 form template is accessible online, requiring only an internet connection and a web browser. There are no specific system requirements, making our template easily accessible from any computer or mobile device.

Yes, our W2 form template is fully editable. You can easily go back and make changes or updates to your form at any time before final submission. This flexibility allows you to ensure that all information is correct and up-to-date.

After completing your W2 forms using our template, you can download the forms for printing and mail them to the IRS and your employees. Alternatively, some versions of our service may offer electronic filing options, allowing you to submit the forms directly to the IRS online.

We offer comprehensive support to all our users. If you have any questions or need assistance while using our W2 form template, you can contact our customer service team via email, phone, or live chat. Our team is dedicated to providing you with the help you need to navigate the tax filing process smoothly.

Our W2 form template is designed to be cost-effective, with transparent pricing and no hidden fees. Depending on your needs, we offer different pricing plans, including options for single use or unlimited access for a period of time. This allows you to choose the plan that best fits your budget and requirements.