🚀 W2 Generator from Paystub

W2 Generator from Paystub - Simplify Your Tax Reporting

Effortlessly Convert Your Paystubs to W2 Forms

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

PaystubHero has solutions to All Your document needs

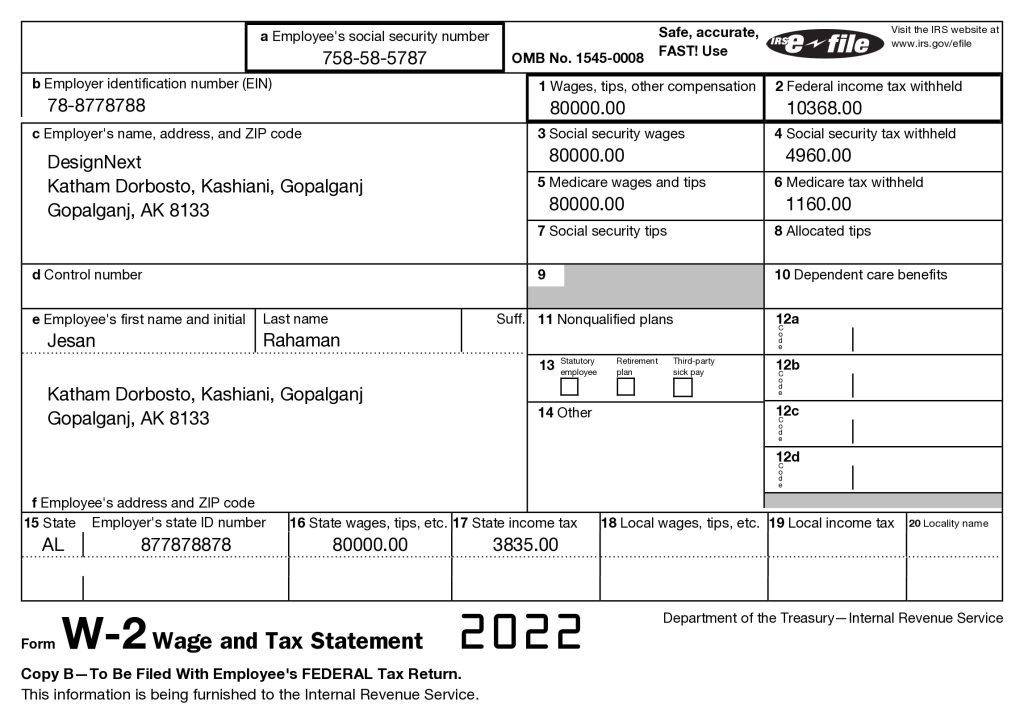

What is W2 Generator from Paystub?

The W2 Generator from Paystub is not just a tool; it’s a revolutionary solution designed for employers, freelancers, and small business owners across the United States, aiming to simplify the complexities of tax reporting. This innovative online platform transforms the traditional, error-prone process of manually creating W2 forms into a streamlined, automated system that guarantees accuracy and compliance with the Internal Revenue Service (IRS) standards.

In the heart of tax season, the accuracy of W2 forms is paramount. The W2 Generator meticulously converts the details from pay stubs into fully compliant W2 forms, reflecting an individual’s annual wages and the amount of taxes withheld. This process not only ensures that businesses meet their tax obligations accurately but also significantly reduces the risk of errors that can lead to audits and penalties.

Understanding the importance of adherence to tax laws, the W2 Generator from Paystub incorporates up-to-date IRS guidelines and regulations into its functionality. This compliance-first approach reassures users that every W2 form generated is in line with the latest tax filing requirements, providing peace of mind and reliability.

Moreover, the platform addresses a critical gap in the market by offering a solution that is accessible to users with varying levels of financial literacy and technical expertise. Its user-friendly interface allows for easy navigation and operation, making the task of generating W2 forms from pay stubs as straightforward as entering basic information and clicking a button.

By leveraging this tool, users can avoid the common pitfalls associated with manual W2 form preparation, such as miscalculations, missed deductions, and incorrect tax rates. Instead, they can enjoy a hassle-free process that not only saves time but also ensures that they remain in good standing with tax authorities, avoiding unnecessary stress during tax season.

In essence, the W2 Generator from Paystub embodies a forward-thinking approach to tax documentation, offering a blend of accuracy, efficiency, and compliance. It stands as a testament to how technology can be harnessed to solve real-world problems, making it an indispensable asset for anyone looking to simplify their tax reporting process.

Addressing the Market Problem

The process of creating W2 forms from paystubs presents a significant challenge for many, especially small businesses, freelancers, and independent contractors. Traditionally, this task has been fraught with potential for errors, from incorrect data entry to misunderstanding complex tax codes, leading to inaccurate tax filings. Such inaccuracies not only consume valuable time in revisions but also raise the risk of IRS audits and financial penalties. Furthermore, the manual effort required to convert paystub information into W2 forms is both time-consuming and inefficient, detracting from core business activities and contributing to the stress of tax season. This scenario underscores a pressing need for an automated, reliable, and user-friendly solution to streamline the W2 generation process, ensuring accuracy and compliance with tax laws, while freeing up time and resources for more strategic tasks.

Introducing Your Market Solution

In response to the pressing challenges faced by businesses and individuals in generating accurate W2 forms, our W2 Generator from Paystub emerges as a robust market solution. This platform revolutionizes the approach to tax documentation by automating the conversion of pay stubs into W2 forms, ensuring precision, compliance, and efficiency. By leveraging advanced algorithms and a user-friendly interface, our solution minimizes the risk of errors that can lead to audits and penalties, thereby safeguarding users against common pitfalls associated with manual tax preparation.

Our W2 Generator significantly streamlines the tax reporting process, allowing users to generate compliant W2 forms quickly and effortlessly. This not only saves valuable time but also reduces the stress and complexity traditionally associated with tax season. By automating a task that once required hours of meticulous work, our platform frees up resources, enabling businesses and individuals to focus on their core activities and growth.

Moreover, our commitment to staying abreast of IRS regulations ensures that every W2 form generated meets the latest compliance standards. This peace of mind is invaluable for our users, who can trust in the accuracy and legality of their tax documents. In essence, our W2 Generator from Paystub offers a comprehensive solution to a widespread problem, embodying efficiency, reliability, and legal compliance in tax documentation. It stands as a testament to the power of technology in simplifying complex processes and solving real-world challenges, making it an indispensable tool for anyone looking to streamline their tax reporting process.

Exclusive Features of Our W2 Generator from Paystub

Our W2 Generator from Paystub is at the forefront of transforming the arduous task of tax preparation into a streamlined, efficient, and error-free process. This platform is not merely a tool but a comprehensive solution designed to address the nuanced challenges of generating accurate W2 forms from pay stubs. Below we delve into the expansive features that set our generator apart, making it an indispensable asset for employers, freelancers, and small business owners alike.

Precision and Accuracy

At the heart of our platform lies a commitment to unmatched precision. Utilizing sophisticated algorithms and data validation checks, the W2 Generator ensures that every piece of information converted from pay stubs to W2 forms adheres to the highest standards of accuracy. This meticulous approach not only mitigates the risk of common errors but also aligns with IRS regulations, safeguarding users against potential audits and penalties.

Effortless Time Management

In recognition of the premium placed on time, our solution is engineered to expedite the tax document generation process. What traditionally could consume hours of manual data entry and verification now unfolds within minutes, courtesy of our streamlined platform. This efficiency translates into a significant time saving, empowering users to reallocate their precious hours towards more impactful activities or business growth initiatives.

Intuitive User Experience

Emphasizing accessibility, the W2 Generator boasts a user-friendly interface that demystifies the tax preparation process. Designed for intuitive navigation, the platform welcomes users of all technical competencies, enabling them to generate W2 forms with ease and confidence. This inclusivity ensures that the task of tax reporting is no longer daunting but a manageable, straightforward undertaking.

Unwavering Security

Recognizing the sensitive nature of financial data, our platform is fortified with advanced security measures. Employing robust encryption and stringent data protection protocols, we ensure the confidentiality and integrity of user information. This commitment to security provides users with peace of mind, knowing their financial details are safeguarded against unauthorized access.

Streamlined Tax Reporting

Beyond individual features, the collective capability of our W2 Generator revolutionizes the tax reporting landscape. By automating the conversion of pay stubs into compliant W2 forms, the platform eliminates the complexities and stress traditionally associated with tax season. Users can navigate the intricacies of tax documentation with unparalleled ease, backed by a system designed for accuracy, compliance, and efficiency.

Adaptable and Future-Proof

In an ever-evolving tax environment, our platform remains agile, continuously integrating the latest IRS guidelines and tax reporting standards. This adaptability ensures that the W2 Generator remains a future-proof solution, poised to meet the changing needs of users and the regulatory landscape.

Our W2 Generator from Paystub transcends traditional tax preparation methods, offering a holistic solution that addresses the core needs of accuracy, efficiency, and security. By harnessing the power of technology, we provide a platform that not only simplifies the generation of W2 forms but also redefines the user experience in tax reporting. This transformative approach underscores our dedication to innovation, making our W2 Generator an essential tool for anyone seeking to optimize their tax preparation process.

*10% discount going on for the first time. Use coupon code: WELCOME10

Benefits of Using Our W2 Generator from Paystub

Maximize Efficiency and Compliance with Our W2 Generator from Paystub

Discover the Advantages of Our W2 Generator from Paystub

Elevate Your Tax Reporting with the Precision of Our W2 Generator from Paystub

Streamlined Process

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Step-by-Step Guide to Creating a W2 Form Image

Follow our simple step-by-step process

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate W2

Instantly create a digital copy.

4. Download

Access your W2 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just Only $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Invoice

$11.99

/ Per Invoice

Unbeatable Value at Just Only $11.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Offer Letter

$12.99

/ Per Offer Letter

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

We've Helped 839,492 Customers Create Their Paystub Template Using Our Stub Generator

Frequently Asked Questions

Our W2 Generator employs sophisticated algorithms that meticulously analyze and convert paystub information into W2 forms. This process includes automatic checks for common errors and adherence to the latest IRS guidelines, ensuring each form is accurate and compliant. Additionally, users have the ability to review and confirm details before final submission, further enhancing accuracy.

Yes, our platform is designed to accommodate the needs of businesses of all sizes. You can generate W2 forms for multiple employees efficiently, saving you significant time and effort. Our batch processing feature allows you to upload paystub details for numerous employees simultaneously, streamlining the W2 generation process.

We prioritize the security of your data with top-tier encryption technologies and stringent data protection protocols. Our platform ensures that all information entered or uploaded is securely stored and protected from unauthorized access, giving you peace of mind regarding the confidentiality of your financial data.

Our platform is designed for efficiency, allowing you to generate a W2 form within minutes. Once you input or upload the necessary paystub information, the generator processes this data swiftly, providing you with a ready-to-use W2 form that meets all IRS standards.

Absolutely. We continuously update our platform to reflect the latest tax laws and IRS guidelines. This ensures that every W2 form you generate is compliant with current regulations, safeguarding you against potential issues during tax filing season.

Our platform offers easy-to-use editing features, allowing you to make corrections or adjustments to your W2 forms before finalizing them. If you spot an error, you can quickly edit the affected sections, ensuring the accuracy of your tax documents.

Yes, our generator is equipped to accommodate state-specific tax requirements alongside federal guidelines. It automatically applies the relevant tax rates and regulations for each state, ensuring your W2 forms are fully compliant on both state and federal levels.

No special software is required. Our W2 Generator is a web-based platform, accessible from any internet-connected device, including computers, tablets, and smartphones. This makes it convenient for you to generate W2 forms anytime, anywhere.

Our platform is designed in strict adherence to IRS regulations, ensuring that every W2 form generated meets all necessary compliance standards. We stay informed of any changes to tax laws to incorporate them into our generator, providing you with IRS-compliant documents.

We offer comprehensive support through various channels, including email, live chat, and a detailed help center. Our dedicated customer service team is available to assist you with any queries or issues, ensuring a smooth and efficient experience with our W2 Generator.